How To Easily Prepare For Bull Volatile Market Regime

|

It's an end of an era, well a few months of making some pretty big piles of cash at least. Why you ask? We are moving from Bull Quiet to a Bull Volatile market regime. The main characteristic of a bull quiet regime is that you just want to be long and you want to add as much as you can to the long positions while in this regime. You want your biggest exposure in this regime, levering up a lot. You want to own the best performers and leave the weaker performers alone. And you do not want to get caught up in the game of buying the underperformers expecting that they will catch up to the leaders, you might make some money but you will do far better by the leaders even when it seems that they are too expensive. This is a trap that middle-skilled traders get caught up in. Low skilled traders and high skilled traders have no problem with taking these types of trades. Look at the Futures on $ES and $NQ, where Nasdaq futures were clearly in charge this entire run-up and traders who took the S&P were taxed HEAVILY for not buying the leader. From the absolute lows on March 22, the $ES is up 46% while the $NQ is up 59%, that's a 13% "tax". |

But it's more than that, when you have a position moving in your direction your available margin increases with the move and you can use a technique called "using the market's money" to continue to add to your positions.

Using the market's money is when you continue to add to winning positions with the open profits that your position has generated, rather than the closed profits.

Yet another technique of a Low Skill or High Skill trader, Middle skill traders don't do this. Lock this away in "how to trade a bull quiet market" and let's move on to bull volatile.

If you didn't know this about buying the strongest in a bull quiet and using the market's money, you might be that Middle Skill trader...but don't worry, you are on the right path. Without mentorship and a community of fellow traders to help you improve it'll take a long time, perhaps forever to become a High Skill trader.

This is exactly what we are doing in the Trading Lab, join us! We will be raising prices soon.

Let's look at what we have in front of us.

A number of big names have moved into Bull Volatile regime, here are few.

Remember the email I sent out about a month ago I broke down some major characteristics of the different market regimes.

Here's what you need to know about Bull Volatile

Bull Volatile

This is a requirement for a long term market top (but doesn't indicate a major top). Major market tops don't happen outside a Bull Volatile regime!

If I've been riding a long term uptrend I look to take profits in this regime or lighten my exposure

If I'm trading more tactically I'm trading FVBO and lighter position sizes, usually max 1% risk

Price is highly volatile up here, moves up and down are bigger

Fear and greed is on full force!

I will be lightening my exposure to Gold and Nasdaq position in my trading account (not the Monthly Macro ETF portfolio).

There are a number of directions the market can go from here, but they are a lot less obvious than they were in the Bull Quiet Regime.

Hopefully, you made some good money these past few months, if so you might want to take a few months off and enjoy those profits.

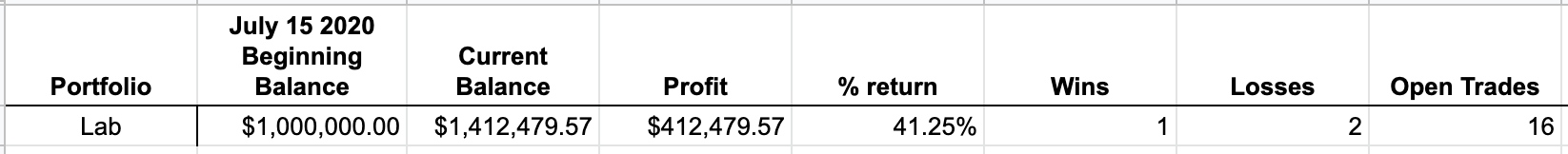

Meanwhile, in the lab we are doing decent and getting adjusted to the new regime conditions.

Everything you need to bring your trading to the next level.

If you are interested in this stuff, Have a look at what we have to offer. Also think about joining us in the Lab, we work on these projects every day together

Subscribe to our newsletter

We look at markets differently at Pollinate. Our main focus is on identifying market regimes, discovering the characteristics of those regimes, and matching strategies to exploit these regimes. Sign up and find out how we do it.

Join the Lab!

The lab is a private slack group where professional traders, proprietary traders, traders at hedge funds and portfolio managers collaborate 24/7 covering our unique views on markets.

Master consistency and systems trading with our courses

We will help you build a profitable trading system that will consistently earn for you day after day.

Sign up for the free newsletter

I will send you proprietary research, strategies and insights that you won't find anywhere else, exclusive only to email subscribers.