Knowing how to trade in different Market Regimes is just as important, if not more so, than what to trade. So what is a Market Regime?

A Market Regime is a quantified method of organizing the characteristics of different trading environments. We have five:

- Bull Volatile

- Bull Quiet

- Neutral

- Bear Quiet

- Bear Volatile

Each regime is a measurement of direction of travel of the underlying asset, Bullish, Bearish or Neutral.

And further organized by Volatile or Quiet.

This is measured with a tool called the System Quality Number (SQN) you can view a video about it here. The SQN measures the average % change from close to close of the previous 100 days and then square roots it. This is how we quantify bullish or bearish, if the change is positive on average for the past 100 trading days, that’s bullish and likewise bearish if negative. Then as the % change increases it becomes more volatile and decreases that’s less volatile. A nice quantified methodology to measure.

This methodology is trailing, so the SQN is a trailing indicator, and that’s important to note. The SQN isn’t there to be a holy grail super classified highly fragile high win rate indicator that will tell you when to buy the next 24% up move or to short a market meltdown.

Rather it’s more like a calendar. If you know that it’s January and you are in Montana, you are more likely to need a heavy coat, boots, hat, gloves and you can pretty much be guaranteed you won’t need a tank top and flip flops.

The SQN is similar because now we can quantitatively recognize the “season” we are in. Like a Calendar would suggest it’s winter and you know you are in Montana, the SQN is saying we are in Bear Volatile regime so let’s get the appropriate tools (attire in this analogy).

Let’s jump in to this weeks action.

Looking at the S&P 500 index on April 6, 2020, this weeks market action is characteristic of the transition between Bear Volatile and Bear Quiet regimes. It gets tricky in here as optimism starts to kick in as we rally from the depths of hell back to where we are now.

Bears are nervous and are covering their shorts or waiting to cover their shorts, bulls who got punched in the throat last month and sold at the first bounce are starting to wonder if they did the right thing and start buying. This is what fuels bear market rallies, the most violent of all rallies.

As you know we aren’t here to call bottoms or tops, we let the market regimes guid us. What works in a Bull Quiet regime doesn’t work in a lot of other regimes and what worked in Bear Volatile doesn’t work as well in a Bear Quiet and vice versa.

As part of the mentorship program I am running currently, AKA the Trading Thunderdome, we are doing extensive work on finding characteristics of the different market regimes and corresponding strategies to perform in the different regimes.

In order to get accepted into the Trading Thunderdome program you need to have completed the Systems Mastery Course to ensure that you have the proper tools and skills to benefit from the course.

We will be releasing the formal program soon…

We will be running these programs throughout the year, so if you are interested in doing the intense work to become a successful trader, get that course. It’s 1/2 off right now!

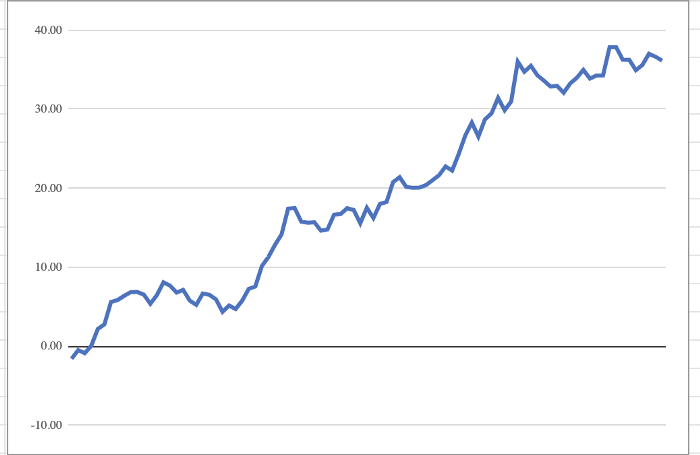

Grant, who is currently in the program did some great work on finding a system that performs quite well in a Bear volatile regime. He settled on the ES (S&P 500 Emini) using the Vol Breakout Short only strategy on 60 minute charts, however lower time frames are equally as good.

And here’s Grant to show you what he discovered…

Hi Traders,

Grant again, one of these days we will do a more formal introduction. However, right now we are going to discuss the how the Volatility Breakout performed on an hourly chart during the Great Financial Crisis of 2008–2009. We will be working through the process of improving this system so that all of you out there will understand how to test systems or ideas.

So, let’s get started.

What is a Volatility Breakout or VBO for short? This is a setup where the Bollinger Bands are within the Keltner Channel signaling a low volatility regime. One of our beliefs is that volatility moves in cycles from low to high volatility and back again. Therefore, we want to see a price breakout above or below both the Bollinger Bands and Keltner Channels. When that bar closes, we place a buy or sell stop above or below the breakout bar. This is a trend-following strategy so we would expect a lower win rate to the FVBO system. However, in certain regime we see the VBO strategy shine. Specifically, the bear volatile regime.

Backtest Notes

1) 12/13/2007–3/6/2009

2) We only took Short VBO Trades

3) All stops were based on the bar close

4) 20-Day EMA Trailing Stop

5) All trades were entered between 7am and 4pm EST

Now that you get the gist of the strategy, lets look at the raw numbers. Also I’ve provided a link to my backtest in Google Sheets, you can take this spreadsheet, make a copy and it’s yours!

Backtest of 2007–2009 Short Only Bear Volatile VBO here

The first thing to note is that this strategy provides a fair number of opportunities. This is important because we want the law of large numbers to work in our favor. The more opportunities we see the greater chance we meet the expectancy of the backtested data.

The next thing I want to draw attention to is the win rate; 61.5%!!! For trend-following systems this is unheard of. Good trend-following systems win just about 40% of the time. This should ring massive church bells in everyone’s head… market regimes matter to strategy selection.

Finally, this system has positive skew. That just means we make more money on winning trades than we lose on losing trades. This provides robustness to the VBO strategy and is important factor in its profitability.

Thanks Grant!

He is doing great work.

And finally now that we had Grants backtest of our “training data set” 2007–2009 Bear Volatile regime, I went and used “test data” of March 2020 Bear Volatile regime and did a ‘hasty backtest’ live on YouTube

The results were very similar for me, though it was just a few weeks of trading.

That’s it for today, best of luck all.

If you want more like this, subscribe to the email list, it's free

Everything you need to bring your trading to the next level.

If you are interested in this stuff, Have a look at what we have to offer.

And think about joining us in the Lab, we work on these projects every day together

Subscribe to our newsletter

We look at markets differently at Pollinate. Our main focus is on identifying market regimes, discovering the characteristics of those regimes, and matching strategies to exploit these regimes. Sign up and find out how we do it.

Join the Lab!

The lab is a private slack group where professional traders, proprietary traders, traders at hedge funds and portfolio managers collaborate 24/7 covering our unique views on markets.

Master consistency and systems trading with our courses

We will help you build a profitable trading system that will consistently earn for you day after day.

Sign up for the free newsletter

I will send you proprietary research, strategies and insights that you won't find anywhere else, exclusive only to email subscribers.