Systems Trading VS Price Action

I've been having a loooot of discussions recently about why I keep calling the current Bull Quiet market regime, well a Bull Quiet market regime.

To be clear I've been calling this current market (in Equity Indices) a Bull Quiet regime for over a month, and you are more than welcome to have a crack at the livestreams I was doing on YouTube last month to see my thinking here

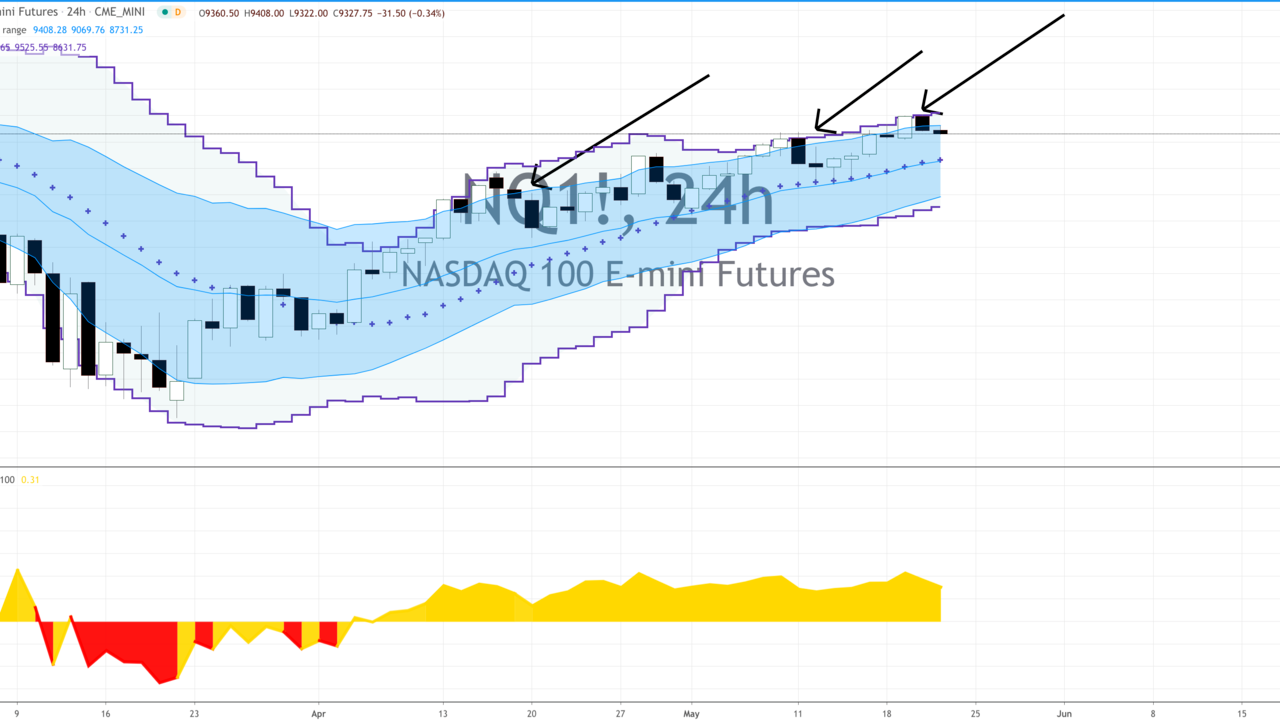

Bottom line the big tell was that the market was showing off these AMAZING sell setups, on $NQ and $QQQ day after day, only to see them stopped out and the price powered higher.

In fact the biggest tell was the power reversal of that major low, when the world was at its most pessimistic and the central banks worldwide stepped in, in a big way.

As systematic traders here we don't care about the news that caused it, but it takes some price action knowledge to understand what is happening there.

If nothing else this could be one of the best representations of how important respecting what price is telling us, vs what the indicators are telling us.

I always point out the SQN is a LAGGING indicator, it takes a long time to turn the ship on SQN but when it does, it's usually smooth sailing. Currently, the SQN on $NQ is still not in a bull quiet, and yet the market is trading with textbook bull quiet characteristics.

What are bull quiet characteristics? The number one characteristic is that the market prints the most bearish and perfect sell setup pattern, and it fails, sell setup after sell setup.

On that chart alone there were 8, count them 8, beautiful sell setups. All 8 of them had people on Twitter, CNBC and Bloomberg News (not to mention ZeroHedge but that's a lost cause) calling for market tops and the "second leg down bear market" over and over. Only to be hilariously wrong, again and again.

My beloved SQN indicator missed it, by a long shot.

And this is why indicators are merely helpful. They are there to keep things in to context, but not the holy grail we want them to be.

The FVBO strategy however has nailed 3 shorts in a row. And this is how we use indicators intelligently.

We let market regime (SQN) tell us that we are in a neutral regime, so with that information we know based on our backtesting that the FVBO strategy is by far the best strategy to trade with in this regime.

So we wait for a FVBO, long or short, take it, and take profits at +1.4R

3/3 = +4.5R

And we also know that we can size this trade up dramatically, 5% to 10% risk using FVBO in sideways regime (as per SQN).

While price action is king, we can sit long with 1% risk or we can just wait for FVBO setups and take monster positions.

Both are very low intervention strategies, as in we don't need to do a lot of work, and just let them play out.

The price action approach is nice as we can continue to add on each pullback and not worry much about being stopped out as we know the market will just keep trickling higher making bears look like idiots, day after day.

The FVBO approach is nice as we just need to sit on our hands waiting for a setup, enter it, then take profits ruthlessly knowing that we are counter trend trading and we need to hit it and quit it!

If you want more insights like this then sign up for FREE or join a community of professional traders from Hedge Funds, Family Offices, Prop Firms and individual traders in the Trading Lab

Everything you need to bring your trading to the next level.

If you are interested in this stuff, Have a look at what we have to offer.

And think about joining us in the Lab, we work on these projects every day together

Subscribe to our newsletter

We look at markets differently at Pollinate. Our main focus is on identifying market regimes, discovering the characteristics of those regimes, and matching strategies to exploit these regimes. Sign up and find out how we do it.

Join the Lab!

The lab is a private slack group where professional traders, proprietary traders, traders at hedge funds and portfolio managers collaborate 24/7 covering our unique views on markets.

Master consistency and systems trading with our courses

We will help you build a profitable trading system that will consistently earn for you day after day.

Sign up for the free newsletter

I will send you proprietary research, strategies and insights that you won't find anywhere else, exclusive only to email subscribers.