Weekly Market Overview December 5, 2021

Dec 04, 2021It has been an eventful week, to ring in the last month of the year.

In last weeks Weekly Market Overview I mentioned that I WAS concerned with the way the markets traded that Friday (a half day) after US Thanksgiving.

Normally I wouldn't be too concerned with some selling on a low volume holiday week, and it may be nothing, but when you have MORE volume on a 1/2 day, the day after a holiday, than you get during any normal week, that makes me take notice.

On top of that, the price action, my preferred method to analyzing markets, shows that the markets opened on a big gap lower, then continued to sell off all the way to close the day (and week) on its lows.

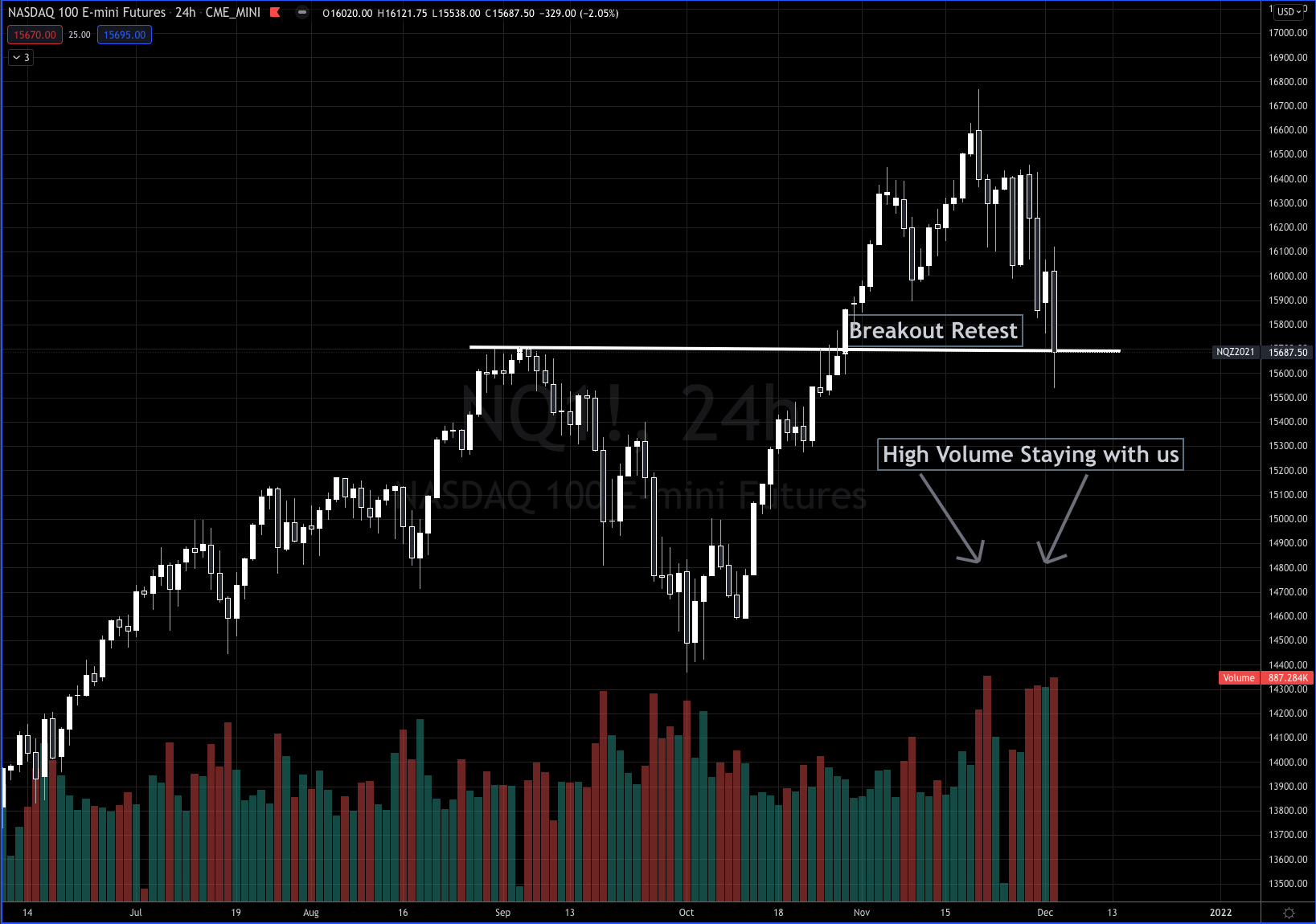

That was what the Nasdaq 100 ($NQ) looked like November 28th, last weekend 👆

I also mentioned last week that I wasn't confidently claiming to buy the dip, simply because we are in the Bull Quiet market regime.

It turned out to be the right move, thus far. Since the Friday after Thanksgiving selloff we've sold off further, and the higher volume during this selloff remains.

So the reaction (what happened after), to the action (the Friday selloff) was bearish with two bigger selling days, where the $NQ was down more than 2% on the day.

This isn't an easy job, because you have to constantly be updating your analysis. You can just look at the market one day last week and be done making decisions, it's an ongoing basis.

Now, we have to again watch the reaction to the action.

Nasdaq is retesting the October breakout (of Septembers high) level at 15708.75, we dipped below it on Friday, and rallied back to it by the end of the day.

The action was going below the breakout level and rallying back.

Another interesting point is that 15,567.75 is exactly 50% from the October low to the November high. Yes 50%, that famous Fibonacci level showed up to the party. I'm not a Fibonacci user to generate trade ideas, but a lot of other traders are, and that could be interesting.

Now we watch for the reaction to the breakout retest, this 50% Fibonacci retracement and most importantly the price action.

How $NQ trades in the coming days will be what I'm spending my time doing, watching the reaction to the action!

Digging a bit into the internals of the market, we can see the 11 different S&P500 Sectors and how money has been rotating this week.

Consumer Discretionary ($XLC) is down the most on the week, while Utilities ($XLU) are in the top spot.

Let's look at Friday, since that was the gut punch of the week.

Risk Off, refers to money leaving the risky growth markets and looking for safety. Typically on a Risk Off day, you'll see the $XLK (Technology) drop while $XLU (Utilities) and $XLP (Consumer Staples) rise. And that's exactly what happened on Friday, textbook risk off day.

So yes, Friday was indeed a Risk Off day (duh), but if we back it up to all of 2021, last week was merely a blip of Risk Off behavior.

All of that is harder work than most traders do, it isn't intuitive or as simple as a handful of indicators on a chart. It's something that took me over 20 years of trading to understand and practice, and still takes a lot of focus to be able to get to an answer every day.

What's interesting is that while the $NQ Nasdaq spent last week getting hammered, $AAPL was hanging out (consolidating) around its all time high!

The Swing Beast Momentum Strategy has been long since 144 area, with two new entries since then, with our options up over 400% since the first buy, 178% the second buy and our 3rd down -44%, yes even after the carnage from the past week or two!

Swing Beast Momentum Strategy got long $PFE got long before the new CoVid variant started surfacing. Again, while the market is whimpering, we're up over 100% on our $PFE calls in a couple of weeks time. Like Apple, Pfizer is consolidating at new all time highs.

With all of this volatility coming in to the markets we are primed for another big run in equities, it just might not be the names that everyone is focused on.

We'll be watching all of this like a hawk in the Trading Lab, and as a nice bonus, Lab Members get the Swing Beast Strategy for 50% off!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.