How To Trade A Bear Market

Nov 11, 2022It has been a long time since we've had a bear market, or recession for that matter.

Are you prepared to thrive in this type of environment?

Do you have a proven system to withstand bear markets?

Let's have a look at where we are as of November 2022

Thursday's CPI (Consumer Price Index) print came in lower than expected.

Yes, I said lower. And the market responded quickly.

Because a lot of people were off sides on that one. According to Goldman Sachs trading desk yesterday around the middle of the trading session...

"GS TMT -- lots of questions on who is driving this move? quick thoughts on key flow drivers:

1) MACRO COVER BIDS.... ETF 41% of overall tape today. Coupled w/ price action, suggestive of covering at index level. This feels like biggest flow driver today.

2) UNWIND OF MOMENTUM STATEGIES... Our Momentum Pair

was +98% or so coming into today. Today -8% driven by Short Momentum (12 mo losers) +13%. Huge moves in interest rates typically trigger these types of moves.

3) ABATING SUPPLY... On our desk, we have seen some LO supply into bounce (have done a few smaller blocks today for guys "cleaning up portfolios), but WAY less supply vs. what we've seen in recent sessions and weeks (ie yesterday, saw 2mn+ AMZN for sale here / today, zero).

4) EARLY COVERING ...We saw some covering early + momentum type buying early

5) BUY SKEWS ACROSS BOARD... Looking at flows across our equity franchise, Asset mngr's 6% buy skew / HFs 4% buy skew... With every sector net to buy except Energy (8% sell skew there)

They are saying that 41% of their orders were short covering trades from ETF's. In other words, those ETF's were very short and had to cover their short positions yesterday because the rally was so strong.

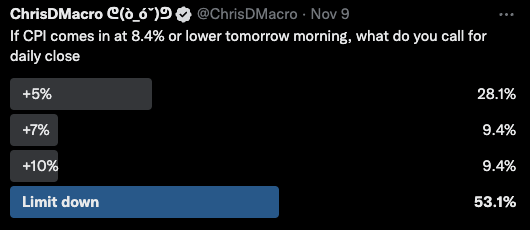

On Wednesday it was quite grim, I ran this poll on my Twitter feed.

This was asking if CPI came in better than expectations, as it id.

Over half the responses expected the market to sell off more than -7% (limit down).

Back to Goldman, on Wednesday they had 2 millions hares of $AMZN to sell. Fast forward to Thursday after the CPI report and they didn't have a single share for sale.

In summary, Goldmans clients were buying everything except energy.

Thursday was one of the top returning trading days in all of Nasdaq's history, the 13th best, and most of it happened in a few minutes time.

Everything that everyone had been shorting all year long, was suddenly ripping faces off.

And the party continues today, everything that everyone had been buying all year long that is profitable on the year, is being sold (profit taking).

For us in the Trading Lab, it was a pretty flat day, only earning 1R.

You'd think a day like Thursday would've been our biggest day of the year right?

Actually Tuesday was a pretty big day for us, up 10R for the day.

Yes Tuesday, a day that the $NDX (Nasdaq) returned +0.68%, was one of our best days in a while.

It's because we are trading a highly robust, scalable, easy to run day trading system.

The Curvy trading system.

This system has changed everything for me.

What's amazing about this system is that it works best in the Bear Quiet, Bull Quiet and Neutral Market Regimes.

Read more about market regimes here

Why is that so important, because the majority of trading days for most assets happen during Bull Quiet, Bear Quiet and Neutral market regimes.

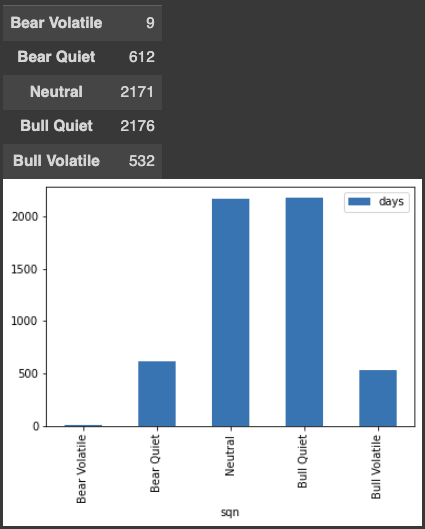

Here's the $NQ (only 9 days in bear volatile, ever)

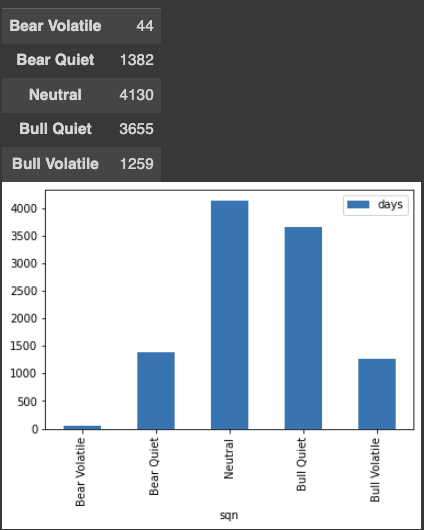

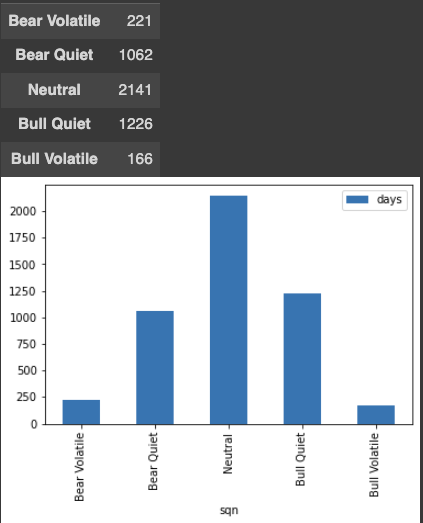

Here's Gold

Here's Apple $AAPL

Here's Exxon Mobile $XOM

Here's the $EUR/USD Pair

In essence you can see that the majority of time, assets trade in those three market regimes.

The Curvy system, when used for day trading, has excellent results during those market regimes.

And since the most amount of trading days find themselves in those market regimes that perform so well, it's important that you run good trading systems that also perform in the majority of trading days.

We've been trading the Curvy system full time in the Trading Lab since October 1st.

In October, we made 52.5R for the month, that breaks down to:

2.5R per day

12.5R per week

So far in November, in the Trading Lab we've made 21R (11 Days in to the month):

2.33R per day

11.67R per week

With the coming uncertainty of a (likely) recession in 2023, anyone who thinks they have job security as an employee, hasn't lived through a recession.

And even if you are self employed, your customers may not be in as good of a financial situation as you are.

Recessions are tough.

I didn't build the Curvy system with the recession in mind, but as I continue to trade it and dig further in to the research I'm excited to know that I have a trading system that will work so well in bear markets and recessions.

You can check it out here.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.