How We Trade Momentum

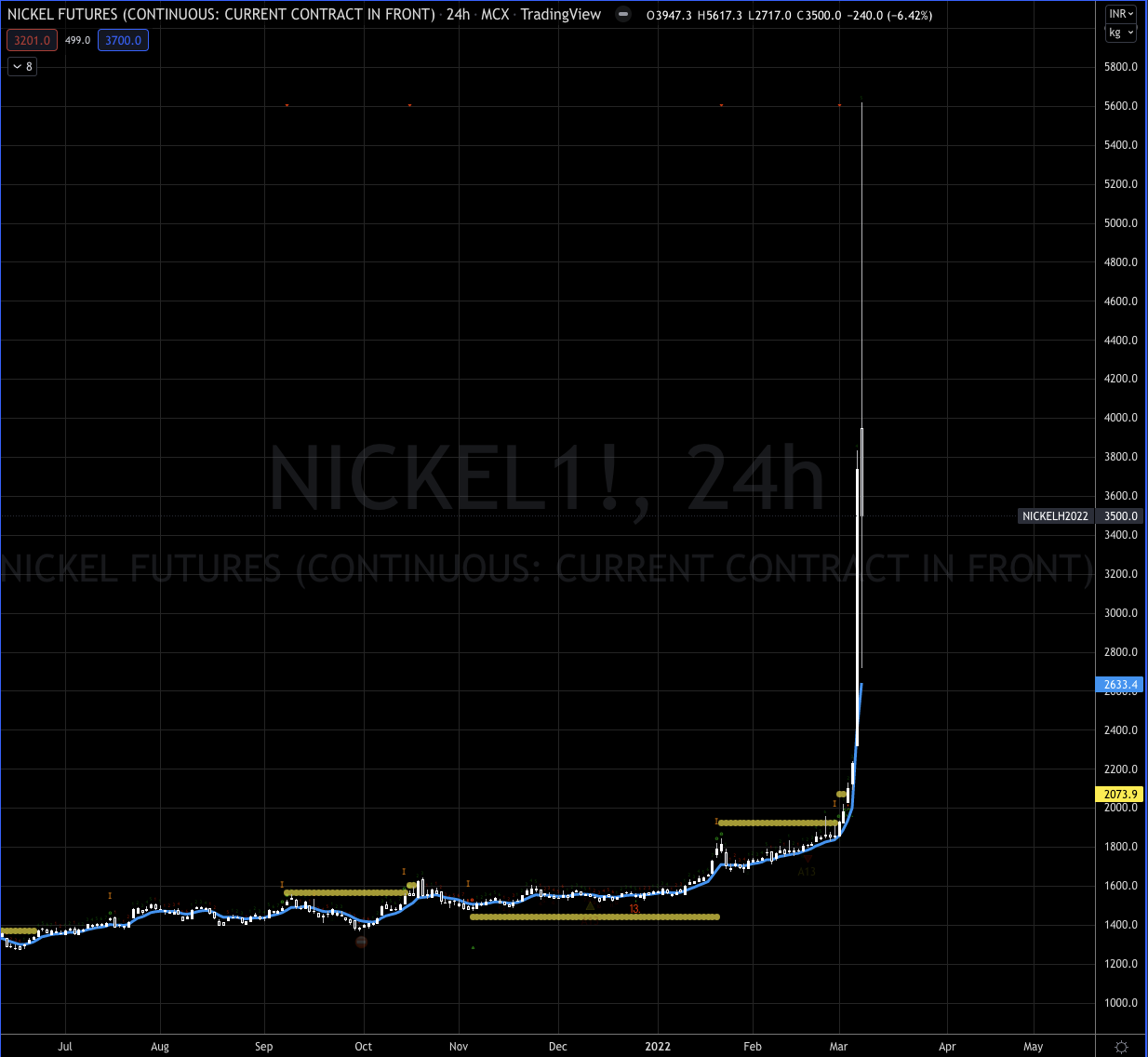

Mar 09, 2022In case you've been living in a cave with no internet, you know that inflation is running wild, oil prices are over $120 per barrel, Wheat has nearly doubled in price since last week, and Nickel was up 100% today alone and has been halted from trading for at least a week.

Each one of those is historical on its own but combined it really paints a picture of how destabilized the world is at this moment.

This is an ideal environment for our Swing Beast momentum strategy.

As a reminder, Swing Beast gets into the high momentum sectors and captures these big, dare I say, massive moves in markets.

When you join the lab, you get the Swing Beast system for 50% off!

Included in the lab are two different proven strategies. The FVBO and VBO strategy. Both include two full courses explaining the strategies in detail.

We kicked off the Swing Beast strategy in Q4 of 2021 and absolutely murdered $AAPL, $PFE, $KO, and $XOM before the equity markets took a dump in January 2022.

On $AAPL alone we took 3 trades from the October lows into the December highs and made more than 1000% (yes a thousand) on our third entry...the latest entry weeks before topping.

You would think that the first entry would've paid the most since we bought it at 143.88, and our third entry was at 163.38, literally 50% higher, and we still made more on that trade than the first entry.

This is the secret to how we enter late in a parabolic trend. Using very low-priced calls we can capture the momentum and turn a $1,500 trade into a $15,000 trade-in in about a month.

We did the same with $PFE, but this time only made a measly 500% 🤷♂️

This past week, we took profits on yet another 1000%+ move in $NOC.

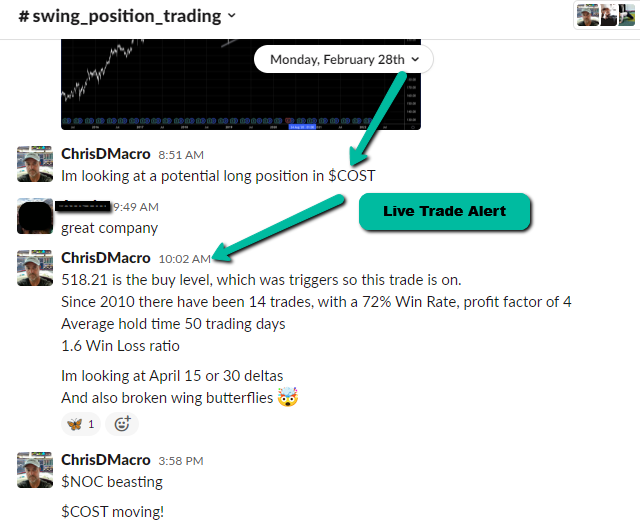

And currently, we are in $COST, which was up over 1000% Within 48 hrs. You can see the actual trade play out here just click below and scroll down on the page.

We are also now in $CAT from 188.23, currently trading at 212.20. The options are over 600% higher in less than a week.

Obviously, Caterpillar is going to be reacting to high agricultural pricing and the increased capacity that will need to be brought online with the boycotting of Russian exports.

It's a crowded trade, but we still crushed. Surprise Surprise.

But that isn't why I got in that trade, it isn't why I got into Northrop Grumman $NOC, a defense contractor, obviously going to benefit from Germany building an army from scratch, a country that hasn't had a military since 1945.

These are clues, but let me get to the real meal deal on how we are attacking this massive run-up in commodities, so late in the game.

First, everyone in the market wants in on Crude, Wheat, Corn, Nickel, or anything that has been ripping double digits plus, day after day.

Everyone wishes they entered these trades weeks ago, they want a time machine.

Even traders who did buy Wheat before the invasion are on the sidelines, most already sold, with shaking hands, scared at their good fortune. Only to watch Wheat pump higher and higher.

With circuit breakers halting trading day after day, the second that contract is released for trading again, you see massive selloffs. Traders want out!

As you can see here, today is the first day that Wheat has traded since February 28, that's 5 straight days of lock limit up, plus a weekend in the middle. Longs were trapped, shorts were destroyed.

A little lesson to you Perma bears, these shorts were margin called, day after day, and couldn't liquidate. Bulls were scared to death too. This is a deadly short squeeze. This will ruin accounts, credit and perhaps your life.

The futures and options on these products are insanely priced, options premium is off the charts.

The margin requirement for the futures contracts is ridiculous.

This has the classic markings of a long-term momentum cycle, which last longer, and go further than most people expect, or can tolerate. This was all covered in today's Live zoom session for Lab members.

(Ready Sunday's Market Overview for a primer on momentum)

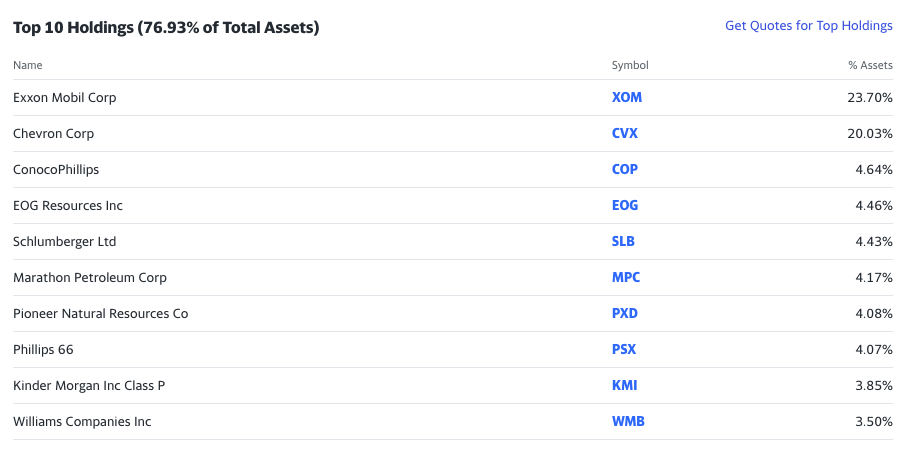

So how do you get access to this mega bull market, and opt-out of the slaughter in tech?

The way we are doing it in the trading lab is finding the companies who will be benefiting the most through this commodity run, obviously.

Let's look at Crude Oil, a beast of a chart!

That monster is too hard to trade within risk parameters, but we can get lower-priced options on energy companies, we are watching the $XLE components to trade.

Wheat is another beast!

$ZC Corn is another one

We are finding the best setups, taking low risks, high reward trades and not fomo'ing in at the wrong time in the Trading Lab.

If you are trying to figure this stuff out, It's time to join us in Trading Lab, we are always deep-diving markets live, and were going especially deep this week!

As a Trading Lab member, you receive...

Daily Livestream - Day trade right alongside me, see what I'm looking at in the markets, work alongside a team of fellow traders.

Daily Morning Brief - each morning I cover what key levels I'm watching, what markets I'm watching that day, and potential trade ideas.

Monthly Macro Trade Strategy - Our long term Global Macro focused ETF end of Month strategy

Swing Trade Alerts - Real-time trade alerts for Options, Futures, Forex, Crypto

Prop Swing Alerts - Designed specifically for Prop Traders who are doing tryouts or managing a live prop account. These are end-of-the-day, swing trades in FX, Commodities, Equities, Metals, Energy, and Interest Rates markets.

Trading Lab Trading Course - I get it, do you pay for a course, or sign up for the Lab? Do both! I created a course for Lab members exclusively, that includes all the different trading strategies, backtesting, trading lessons, techniques, basically a summary of all my courses and everything in the lab altogether. This alone is valued at $2000 but you get it included in your Lab Membership

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.