Less Bullish In Q12021

Aug 05, 2021(Originally posted March 28, 2021)

2021 started out like a continuation of 2020 with tech ripping higher and everything else lagging in the US Equity markets, but as I'm sure you are well aware, the last month (plus) has been anything but.

Below are the year to date returns for Russell, S&P500, Dow and Nasdaq

YTD Returns respectively

- $IWM 12.52% (down from a high of 19.57%)

- $DJI +8.03% (New all time highs)

- $SPX +5.80% (.01% below all time highs)

- $NDX +0.65% (down from a high of 7.13%)

We took profits on over 1/2 of our long $NQ/$QQQ (Nasdaq futures and options) position as our March Futures contracts expired freeing up a lot of capital that we started deploying to $YM/$DIA (Dow Jones Industrial futures and options).

We still retain our $NQ long position with June expiration and will happily build back up our long position there IF $NQ picks up the load again and starts carrying the markets, but the opportunity in $YM and $ES is far stronger looking at the moment.

As we did with the long $NQ campaigns of 2020, we will be looking to see how $YM handles any weakness. In a Bull Quiet market regime we see the best looking sell setups FAIL, and we saw exactly that on Thursday and Friday of last week.

While everyone was all beared up about interest rates and everything else negative in the world, the $YM closed the week at new all time closing highs.

Not only was the sell setup rejected Thursday, it was met with the best looking buy setup in the world. This is behavior you see at the beginning of a bull run, not near the end of one.

The Dow vs M2 money supply as a measurement I keep of how "expensive" an index is to historical levels, is below the 2008 Global Financial Crisis and the 2000 Dot Com Bubble.

We have plenty of room left in the $SPX as well, while the other indices are already rather high

NDX/M2, closer to 2000 highs, but that's what you'd expect from the leader.

RUT/M2 (Also notice the very mean reverting nature of Small Cap Russell 2000)

As my friend Seth Golden fo Finom Group likes to say

"Sector rotation is the lifeblood of a bull market. What was leadership will give way to new leadership and eventually a full cyclical rotation will conclude with the former leadership recapturing its glory. So if you hold the opinion that tech/growth/Nasdaq will lag/wane/flounder forever, then indeed you have to also believe this IS NOT a new cyclical bull market."

$DJI = Bullish

$SPX = Bullish

$NDX = Neutral (cautiously optimistic)

$RUT = Neutral

Currencies

The US Dollar showed up for work last week outperforming all major currencies for the week AND for the year. This is a different narrative than we've heard from everyone about dollar weakness, a failing dollar and this is the end!

- $DXY +3.24%YTD

- $GBPUSD +1.60% YTD

- $CADUSD +1.35% YTD

- $AUDUSD -1.06% YTD

- $NZDUSD -3.06% YTD

- $EURUSD -3.9% YTD

- $JPYUSD -5.53% YTD

- $CHFUSD -6.28% YTD

While I am a big Bitcoin and cryptocurrencies bull with all the opportunity that they pose in offering an alternative to fiat currencies, I am a trader and I don't have to take a strong belief either way in how the dollar performs. Personally I'd prefer that the global economy doesn't implode and bring mass anarchy. I like the option to root for society not collapsing.

Since February we had been short Yen vs GBP, CAD, AUD as well as long GBPUSD, we closed out of all those positions two weeks ago and moved into long USD short EUR and JPY, also short EURCAD with a very tactical FVBO long on GBPUSD.

Looking ahead the Canadian Dollar has held up substantially better than the other commodity currencies (AUD and NZD) and while I am already long CAD via EURCAD, I will continue to be on the lookout for more exposure if things continue.

The British Pound still has the best potential, also the UK has done a great job in dealing with COVID, shedding the weight of the EU off it's shoulders and primed to emerge stronger than, (no, not stronger than ever), stronger than before they joined the EU. They will need a strong currency to do so giving them purchasing power and historically $1.50-1.70 vs USD has been a consistent level. I expect to see 1.50 this year and maybe even 1.70 by then.

Commodities

Crude Oil $CL (WTI) has made a strong recovery from its negative price debacle in April rallying all the way back to above $60 per barrel and basing out where it spent most of 2019. Though the world is a million times different in 2021 than it was in 2019, for more than the past decade this does seem to be a median price level for crude.

We have exposure to the energy sector via $XLE (S&P500 Energy ETF) since January 2021 and the $80 level is more likely than not. This doesn't mean that Crude has to trade up to the $80-100 level for $XLE to get there as the XLE holds energy companies, not the commodity. While Crude may hold steady at these levels, keep in mind that these businesses that are components of the XLE can be wildly profitable with a stable oil price, increased market share, and innovation.

With measured move targets up above 70, 100 and if there was a chance of zombie warewolf riots, all the way up to $180!

Adding in some non quantitative thoughts on the sector...

This is also a venture type of play, while the world is focusing on limited energy usage due to its effects on the environment, and the less than ideal green solutions. Wind, you need it to be windy, Solar, you need it to be sunny, and of course you need big expensive batteries to store it for when it isn't windy and/or sunny and batteries require mining, which isn't all that green.

Newer nuclear technologies are a possibility but what about an even cleaner and safer form of energy.

Geothermal Energy offers an abundant solution and the incumbent miners and oil drillers already have the tools and know how to mine "heat" from the earths core, but harvesting Geothermal Energy does not require the environmental footprint that oil harvesting and coal mining do.

Currently the world (for the most part) is over optimizing for reduced energy consumption.

Imagine what would be possible if we over optimized for abundant energy consumption.

Since the COVID lows of March 2020 commodity metals and energy have exploded higher, while agricultural commodities have a relatively tame returns. Corn and Soy have other non food related uses, wheat and cattle have only modestly increased. If inflation does end up burning hotter than expected, food prices would shoot dramatically higher as well.

We are positioned long Ags, via $DBA calls on the Agriculture ETF. With inflation potentially on the table we expect to see rising commodity prices and Ag's are underperforming all other commodities relatively getting us in at the begging of the move, not late in it.

Our time horizon here is 6 months to 2 years out but it could go much further and last a lot longer giving us a lot of optionality.

Measured move targets start at $23 and go all the way up, again if those zombie warewolves do attack, into the $70 levels.

Final Thoughts

Friday a $15bn ($80 Billion dollar notional long portfolio) was liquidated and we were tracking it in real time in the Trading Lab. This gave everyone who was paying attention an opportunity to get long some great stocks that were artificially down on the day.

It was an obvious shopping list if you had some dry capital and had access to fellow traders to help sort it out. I called out the trade in the Trading Lab jumped in to $DISCA calls when the stock was down about -30% on the day.

$DISCA (hourly chart)

For reference here is what the daily chart looked like, you can see what a massive down candle there. The average daily volume for $DISCA was 11.7 Million shares, Friday's volume was 104.4 Million shares, that's nearly 10x the daily volume.

This is the power of collaborating with other traders. It may or may not work out, time will tell. But when a trader for a very large firm (in the Trading Lab) says something like this, you take the gotta consider buying something.

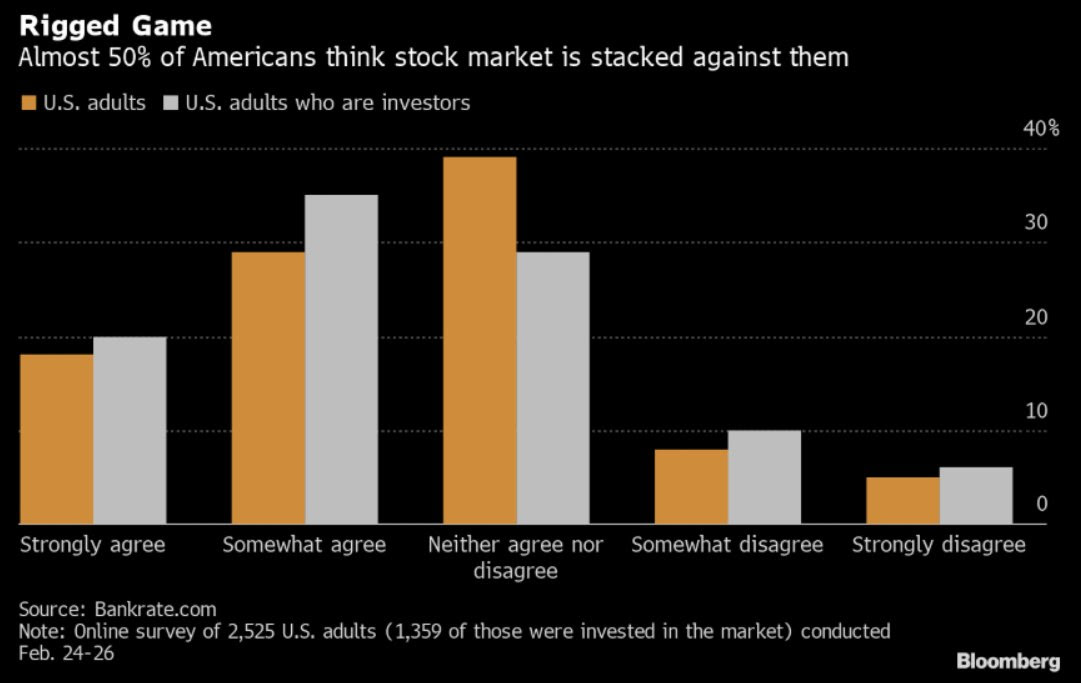

According to Bloomberg, nearly half of all Americans think the stock market is stacked against them...

and they may point to something like Friday's massive bounce which rallied +1.34% in one hour ($NQ) when the massive liquidation selling was finished

I say YES the market is rigged, but I argue there is a very good opportunity for it to be rigged in the small investors favor, remember this was a $15billion dollar fund that just got stomped out of business. For 150 years the US Equities Market (SPX) has risen 79,870.62%

Or to see the rise even better, here's a logarithmic chart

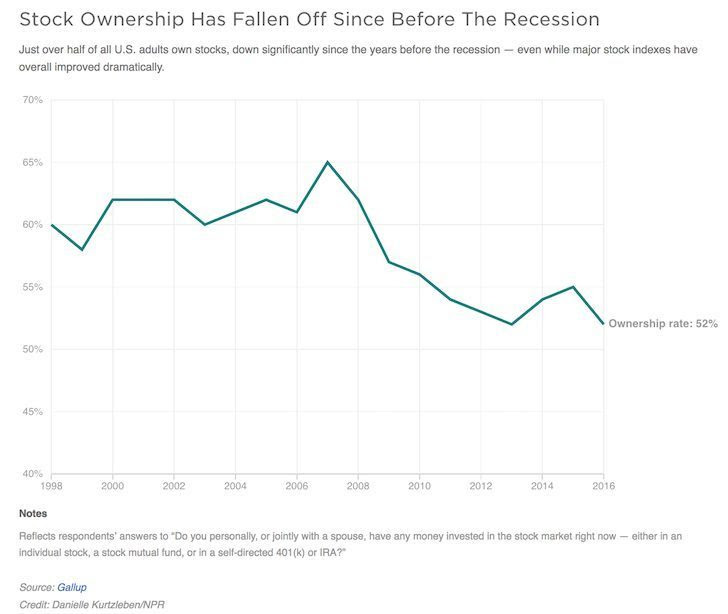

Since 2008 Global Financial Crisis stock ownership has fallen from a high of 65% to 52% today.

As of 2021, the top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of families, it was just under $54,000.

Why am I getting all (kinda) Macro here?

What do we need for a strong bull market? We need buyers. When the last buyer has bought, the market can't go higher anymore.

If 2020 and 2021 have taught us anything, with r/WallStreetBets, Robinhood or the less risky, Sofi, Public, Acorns, and other ways for the under invested to get access to public markets (fractional shares), that bottom 48% there is a route to get invested.

There are still a lot of potential buyers out there, they will slowly show up to the party which gives us a steady bid on the market over the long term.

Some may keep chasing returns, some may opt out completely and go to crypto, but as asset prices continue to inflate, those who don't own appreciating assets will see their buying power diminish and will have no choice but to invest.

A quick note, in the earlier years of Waymar Germany, during hyperinflation, asset prices were on fire, and everyone thought they were actually getting rich. It turned out to be hyperinflation and a $100k life savings (USD Current equivalent) turned into $10 (in buying power) really quickly. So while we enjoy the value of our homes and investments increasing in value Bitcoin and some other Cryptocurrencies do offer an alternative to revisiting the hyperinflation of Waymar Germany in the 1930's.

A good update to Bloomberg's survey above might be, does that bottom 48% think Cryptocurrency/Bitcoin is rigged?

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.