Seasonal weakness, September is historically the...

Feb 15, 2021A quick reminder about the Trading Lab before we get started. If you find trading to be an isolating place, then you aren't alone. I've been trading for over 20 years and I know for sure that the times when I haven't had a team to work with, to bounce ideas off of, to mentor and be mentored, have been my worst periods of trading.

This is why I created the Trading Lab. Having a team of fellow traders at hedge funds, family offices, prop traders and professional traders to ask questions, get real insight on what they are seeing on their trading desk. I can ask an equity trader at a hedge fund what he's seeing in sector flows. I can check in with the prop traders on what they are seeing in FX. And of course EVERYONE has a question about something in Crypto.

We will be increasing prices at the end of the month, so if you are on the fence you should join now and lock in the current price for as long as you maintain the subscription. Join us in the Trading Lab!

On to business...

I've been talking a bunch this week about the equity market taking a breather, specifically the Nasdaq. This is a continuation of yesterdays email.

As you know, I've been very bullish this entire move up, getting in April 5th and adding relentlessly on every single failed sell setup. Though our main indicator that tells us what market regime we are in was not flashing such bullishness, the price action certainly was. Understanding how to use price action and market regimes together is a super power that indicator chasers don't *yet* understand.

As we head in to the last week of August, September will likely follow, that's how calendars work! A main feature of August is low volume, low breadth and a bunch of people on Twitter talking about how "uncharacteristic" the low volume/breadth is. Don't get sucked in, that's not true, August is always like that.

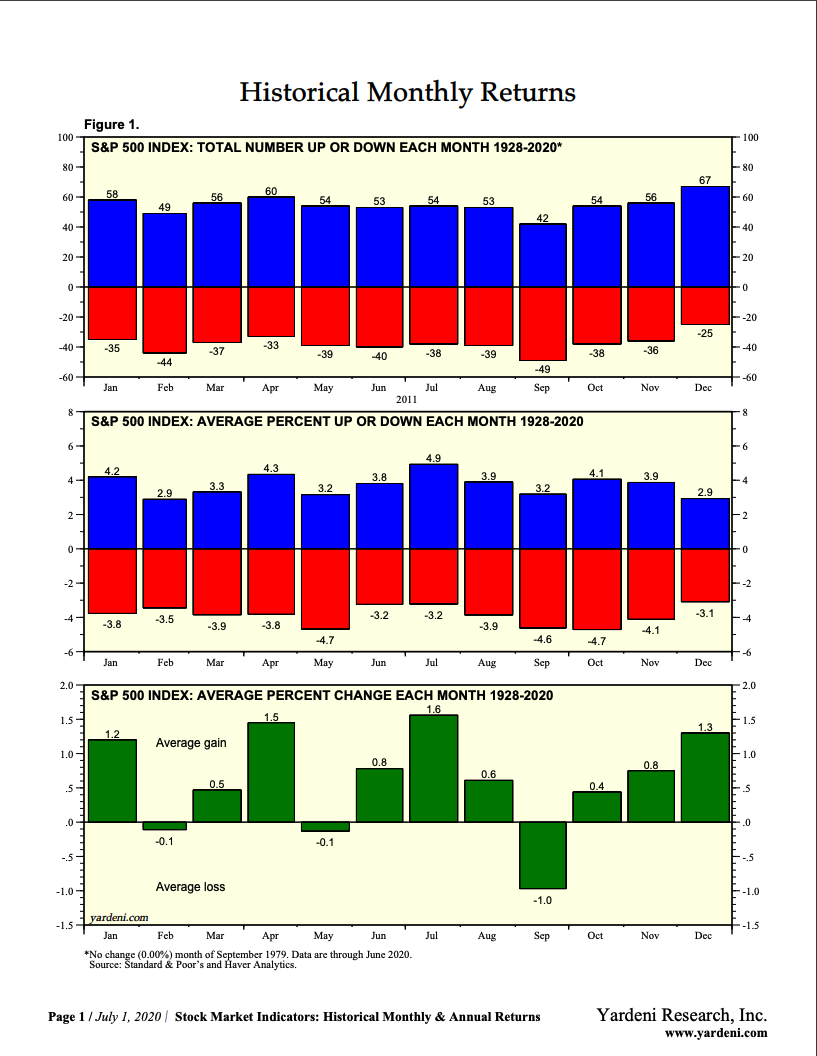

But more importantly September is upon us, AKA the weakest month on average since 1929, of the year.

This alone isn't something that gives me any reason to take profits on my longs, or go short. But it does give us some context.

Next we find the $NQ in the Bull Volatile market regime.

To clarify, bull quiet is a conjunction of 2 classifications. First Bull, this is the direction the market is moving (vs Sideways or Bear).

Next we have Volatile (as opposed to Quiet or low volatility).

This Bull Volatile market regime has some unique characteristics. This regime unlike Bull Quiet is when short selling is allowed again, so the FVBO strategy works well in this regime. This regime is also a requirement to a major market top, but not an indication of one. We can't have major market tops when we aren't in Bull Volatile regime.

And the final piece is the 3 standard deviation move on $NQ. Nearly all minor reversals, and even major market tops/shifts happen when the market closes the month above 3 standard deviations.

We will be watching the monthly close on $NQ closely.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.