Nasdaq Swing Trading System Is Live

Jun 23, 2023Have you ever thought to yourself...

"I just need to build a trading algo to trade for me"

Of course you have, we all have.

But it isn't as easy as it seems.

And i'm not just talking about how hard it is to learn to come up with ideas, create ways to test those ideas, code those ideas, improve those ideas and stress test the code.

What about running the servers. Updating the software on the servers, Updating the codebase when a new exploit happens.

What about when the algorithm goes long right after you just read the most compelling bearish newsletter and you are ready to close all your accounts, buy gold, and go completely off the grid?

Now you have a decision to make, do you leave the trade on? LOL

For the past 6 months I've been working on getting my swing trading algorithms ready for prime time...that is, where I feel comfortable that traders can trade these systems without me?

Well folks, the time has come!

Live Swing Trade Alerts are ready to go.

Let me tell you a bit more about them.

These systems focus on the best sectors and assets, so when Tech is hot, the system is trading tech. When Energy is leading, it's in energy.

It's a momentum based system.

When nothing good is happening, it does nothing...and that's a bit frustrating, but the right move.

The system currently trades:

- $NQ (Nasdaq Futures) or $QQQ (Nasdaq ETF)

- $AAPL

- $AMZN

- $MSFT

How are signals sent?

Right now the only way to receive these trade signals is in the Trading Lab Slack Group.

An alert is generated algorithmically to the Swing Trade Alerts channel (set alert notifications).

You have to be a member of the Trading Lab to get this.

Show me the backtest!

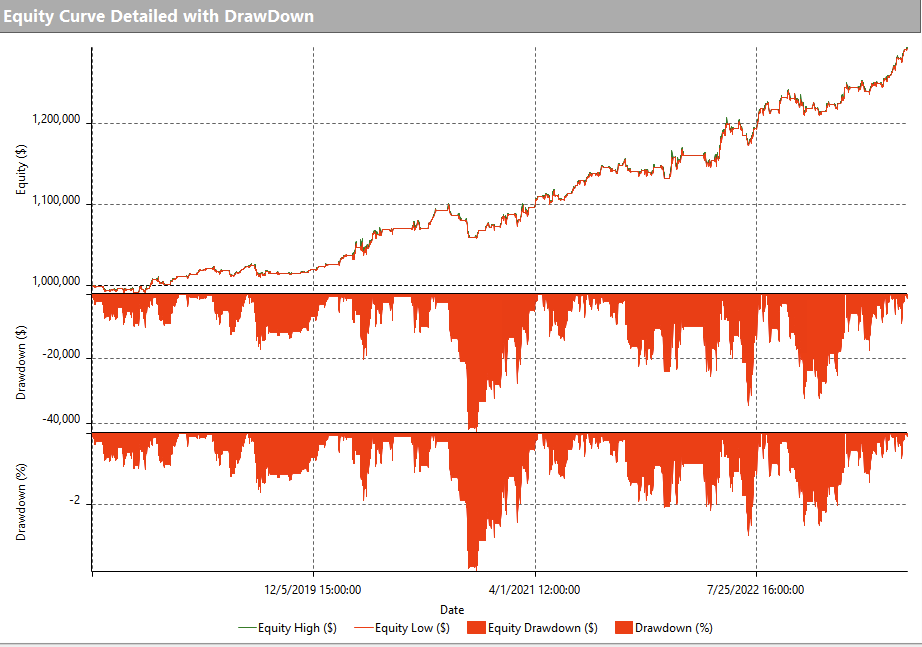

This backtest is for $NQ Nasdaq futures with a standardized 1 Futures contract per $1,000,000.00 (including commissions and slippage):

Total Return on Investment = 28.89%

Total Drawdown = 3.05%

9.66 times your risk

To put that in to context for the same period of time. The Nasdaq $QQQ (ETF) 30% of portfolio $1,000,000 portfolio

Total Return on Investment = 29.16%

Maximum Drawdown = -16.25%

1.8 times your Risk

Or in plain english, for every $1 you risk trading the swing algo, you'd have earned $9.66, vs $1.80 during the same period.

If you are comfortable with a 15% drawdown, like the long only $QQQ method offered, then you'd have made $48 per dollar of risk or 144%

And here are the stats

Of course these are all based on $1,000,000 accounts for standardization.

You can choose to trade 12 shares of $TQQQ, $MNQ futures, $QQQ or any other version relative to your account size.

I will be running my treasury and a portion of our family investments on this strategy.

And let me be perfectly clear here for you prop traders...This is not for day trading futures! It's swing trading.

But perfect for Surge Trader or other places that you can hold overnight and weekends.

If you are currently a member of the Trading Lab, then you have started to see these alerts.

And if you are interested in getting in on this come join us in the Trading Lab.

Even if you aren't interested in making 3R per day day trading futures right along with us, you can catch those nice big swing trades in the alerts.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.