The Best Trading Strategy For Prop Trading

Dec 29, 2022Look, 2022 was an incredible year for traders.

After a couple years of clown town where prices just kept ripping higher on tech stocks, equity indices, crypto, and anyone with a brokerage account could make money...

2022 changed that real quick.

All that excess stimulus money sloshing around made it look like anyone could make money trading, there's always a price to be paid.

In 2022, the traders who could adapt to the new environment did just fine.

As a trader, your job is to make money in markets.

Period.

If you were making money consistently until 2022 happened, it isn't because your trading system wasn't good, it's because you didn't adapt the the new market regime.

What works in a healthy bull market, might not work in a frothy bubble.

What works in the first phases of a bear market, might not work when that bear market lasts longer than a few months.

2022 taught a lot of traders what real trading was all about, and how important it is to adapt.

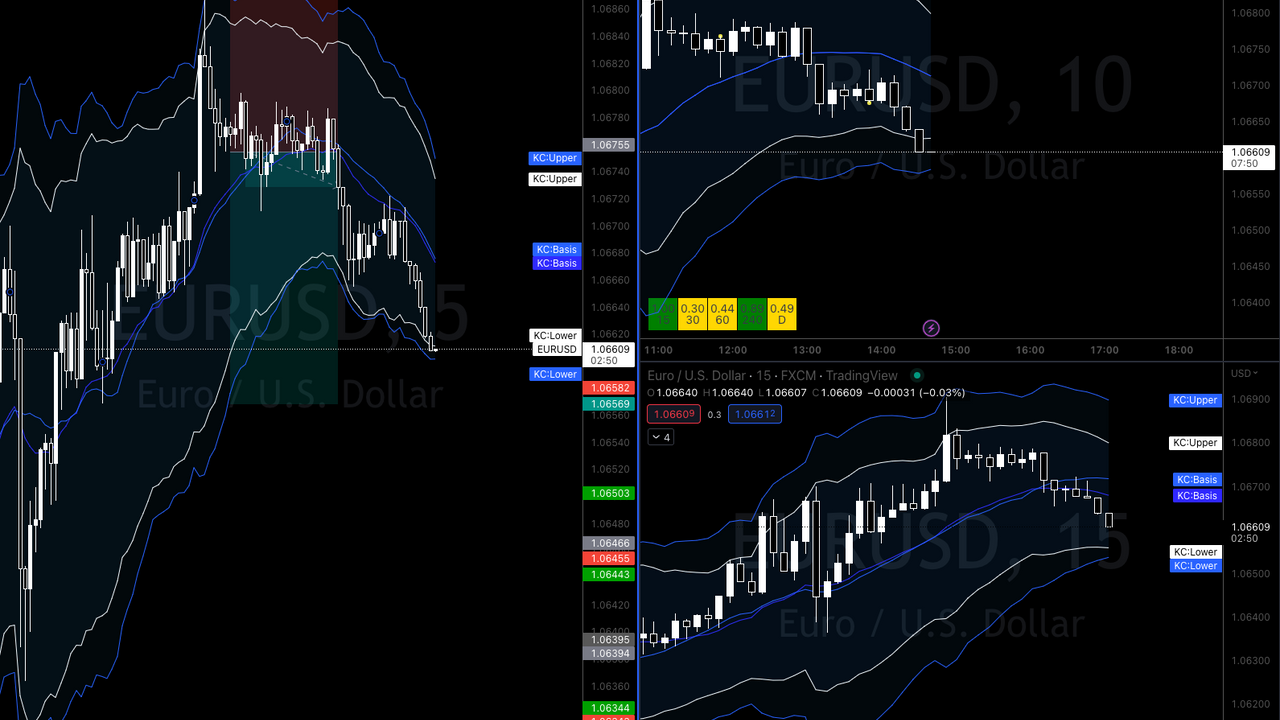

The Curvy trading system is built to adapt to the different market regimes. We continue to build out the system as we speak.

And the biggest thing to happen in 2022 was the new prop firm trading models.

Yes prop firms have been around for a long time, I started trading at my first prop firm in 1999.

The old style was that you would put up the risk capital and the prop firm would get you lower commissions and much larger margin.

Or they'd hire you as an employee, pay you a salary and have you trade their capital and take a % of the profits.

In the late 2000's a new style of prop firm emerged, where you'd pay a fee to do a tryout, and if you passed their challenge, they'd fund you with real money.

On average only 4-5% of traders who tried out, could actually pass the challenge, but that never stopped traders from paying to tryout over and over.

Surprisingly this business model never really took off, until late 2019 when a couple of competitors out of Europe started to offer a similar challenge.

By 2021 things really started to head up in the prop trading space, and new firms were starting almost daily.

All that competition did one amazing thing, it gave traders an almost limitless opportunity to access capital and trade as a professional trader.

With tools like trade copiers, you can open multiple prop accounts at multiple firms and scale up your returns...or protect yourself if one prop firm has issues, then you can keep trading right along.

Imagine if you made $350 today trading $MNQ futures on one account.

Now imagine if you had ten accounts, that's $3500 doing exactly the same thing.

There's so much more to it than just adding new accounts of course, at the top of it is risk management.

And that's why I built the Curvy trading system.

It's a trading system built to thrive in the prop trading world.

Curvy was designed so that even during the worst draw downs, you would never blow up your prop account.

It was designed to make it easy to trade multiple accounts at the same time.

It was designed to make 5% to 10% each month using normal prop firm risk management rules.

But of course not every month is going to be that good, for example December was a 1R month (about .01%), so far.

Yeah, it happens and is a normal part of the system.

Check out the Curvy Trading System

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.