It's Time To Buy

Sep 12, 2022It's rare that I make a very long term directional move in markets. Typically I'm either day trading futures and currencies, or I'm swing trading $AAPL.

But every now and again an opportunity arises that gives me a very long term signal.

By long term I mean the type of trade that I may never exit out of.

That's it's potential.

In reality the setup is usually good for a significant swing trade, the last time it happened was around June 20th, 2022 at 3725.25 on $ES (S&P 500 Futures) or 371 on $SPY.

It also fired off a long January 26, 2022, which was a far less significant up move before continuing lower.

However, over time this sentiment signal has provided the fertile environment for major market bottoms, and tradable swing trade entries.

Rather than just taking this sentiment signal as the be all end all reason to buy the dip, we want to stack other edges on top to create a more robust trading system.

In addition, we don't want to just go long and let the trade go against us if we're wrong...like in the January example.

Even if we don't use anything else other than the sentiment signal (which I'll share with you later in this email), then we MUST use Risk Management to ensure that if this trade turns out like in January, we are only wrong a little.

But if the trade turns out like the June example, or as it did in December 2011 where $ES was trading under $1200 ($SPY under $120), then we are on board and we never look back.

I'll share with you the trade I'm taking to exploit this opportunity. This is not a recommendation to buy or sell, just insight in to how I look to take long term trades, how I manage risk and what products I use.

First let's start with the sentiment signal.

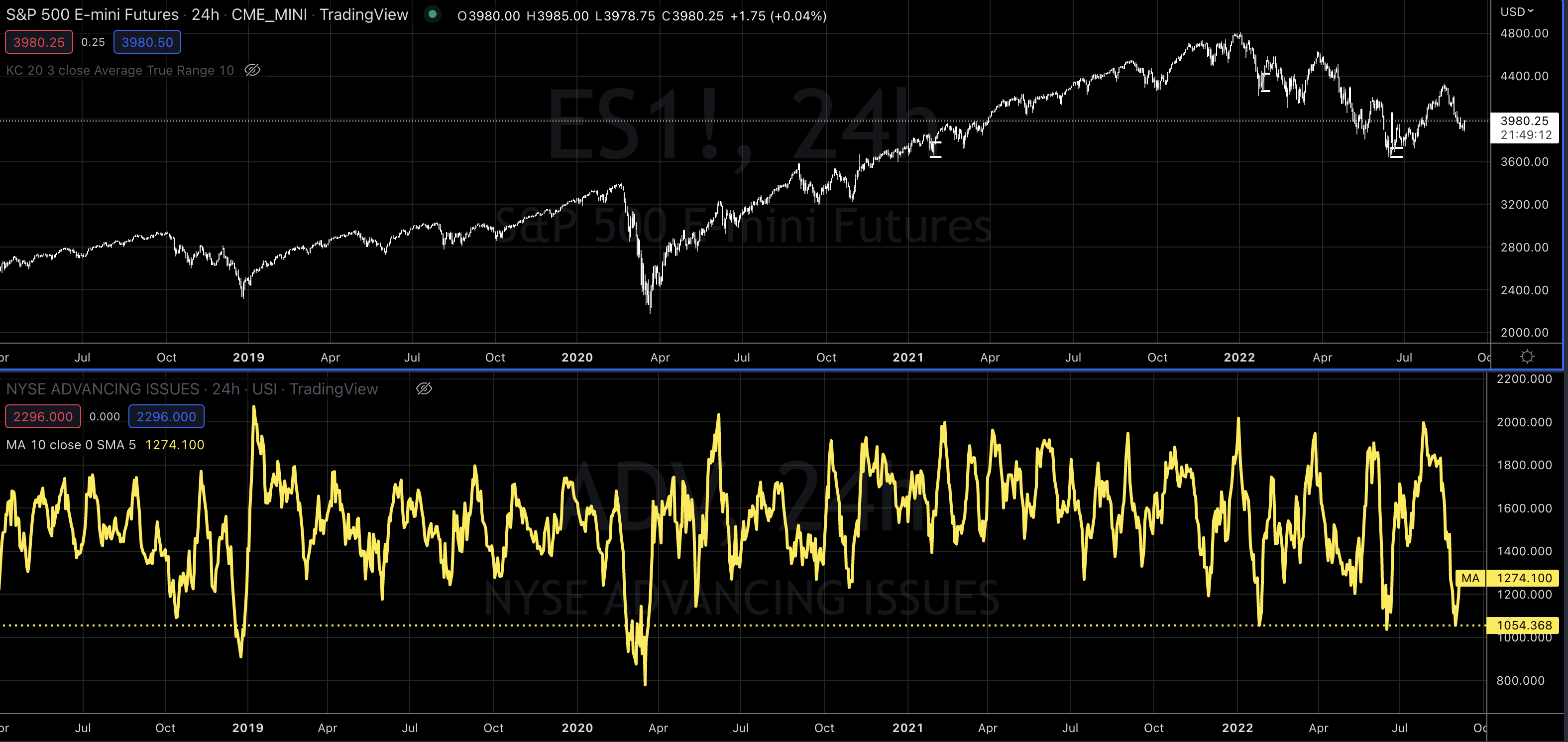

In two chart windows, I plot the $ES/$SPY/$SPX (whichever version of the S&P500 that you will be trading off of).

And the $ADV (New York Stock Exchange Advancing Issues).

Then I put a 10 Day Simple Moving Average on the $ADV chart (and hide the price bars for $ADV).

Each time $ADV goes below 1100 is a signal that a bottom (short/medium or long term) is in place.

Again, I don't just go long when it goes below 1100, I then look for a trade setup.

As you can see, if you simply buy the move below 1100, you'd have had a pretty tough month back in March 2020 and probably 20 other times historically.

Next I wait to see the $ADV 10 day average to turn back up...that's tells me the setup is on and I need to find a place to get long...and a place to put my stops.

That happened today.

I will be making two trades tomorrow.

- adding to my $SPY December 2024 $600 calls.

- buying more $VGT $VTI and $VOO for my son.

My stops on the calls are the premium.

My stops on the $VGT $VTI $VOO trades will be a close below this weeks lows.

This leads me to my swing trading strategy that we are looking to get back in to action in the next few weeks. Swing Beast.

This environment for the S&P 500 means that Swing Beast Momentum Strategy will very likely have an outstanding opportunity in the coming weeks and months.

My absolute favorite stock to trade, $AAPL is setting up for a strong swing season. And while I could (and you could) just buy $AAPL and go about our business, if you are reading this, you are a trader and you want more high expectancy trades...not less.

The Swing Beast Momentum Trading System is an absolute monster at capturing the meat of big moves, and getting you out of the way when momentum is dying out.

Now's the time to grab this system, learn it and get ready for a potentially YUGE momentum season.

PS. I've got one more really big piece of evidence that we can stack on to our market bottom analysis, that I'll be sharing later this week.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.