Weekly Market Overview August 1, 2021

Aug 01, 2021Last week, I went over the way I look for a major market top (I consider this an 8% or greater, dip).

Quickly summarized:

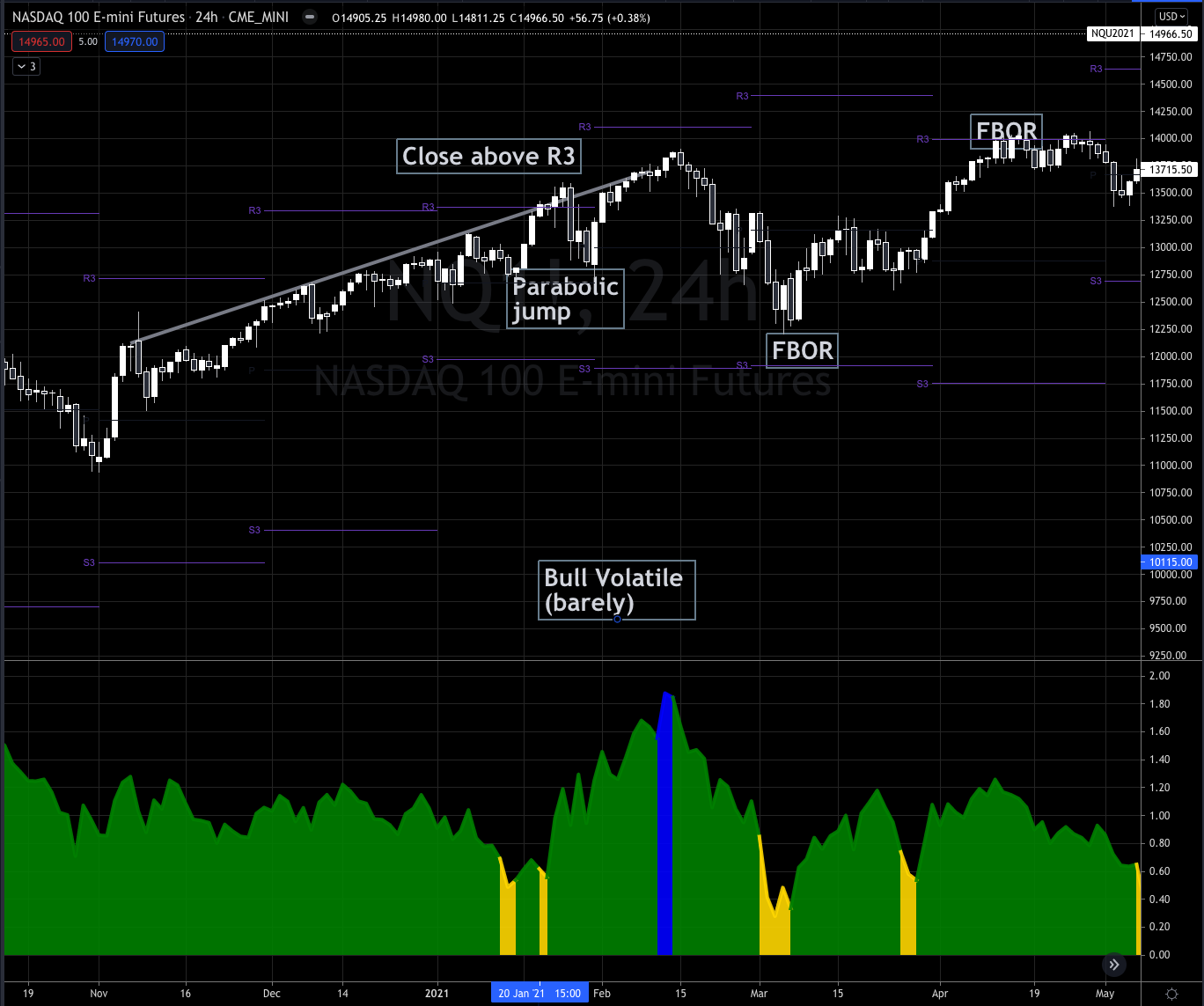

- Bull Volatile SQN Reading

- Price closes above monthly R3 Pivot

- Parabolic rise above trend channel

We start a new month of trading this week and we met exactly 0 of the major market top requirements on the $NQ.

That doesn't mean we throw caution to the wind and market buy our full buying power on leverage, our job is to manage how we take risk and how we limit downside.

We want to take low risk, high probability entries each time the $NQ is tested, and passes that test successfully, which is what we have done since $NQ broke out in June.

From March until June the $NQ was trading in a mean reversion regime, where both longs and shorts work out from the edges of those ranges. Three out of four times the Failed Breakout setups were successful (75% win rate), which was the $NQ passing our mean reversion tests.

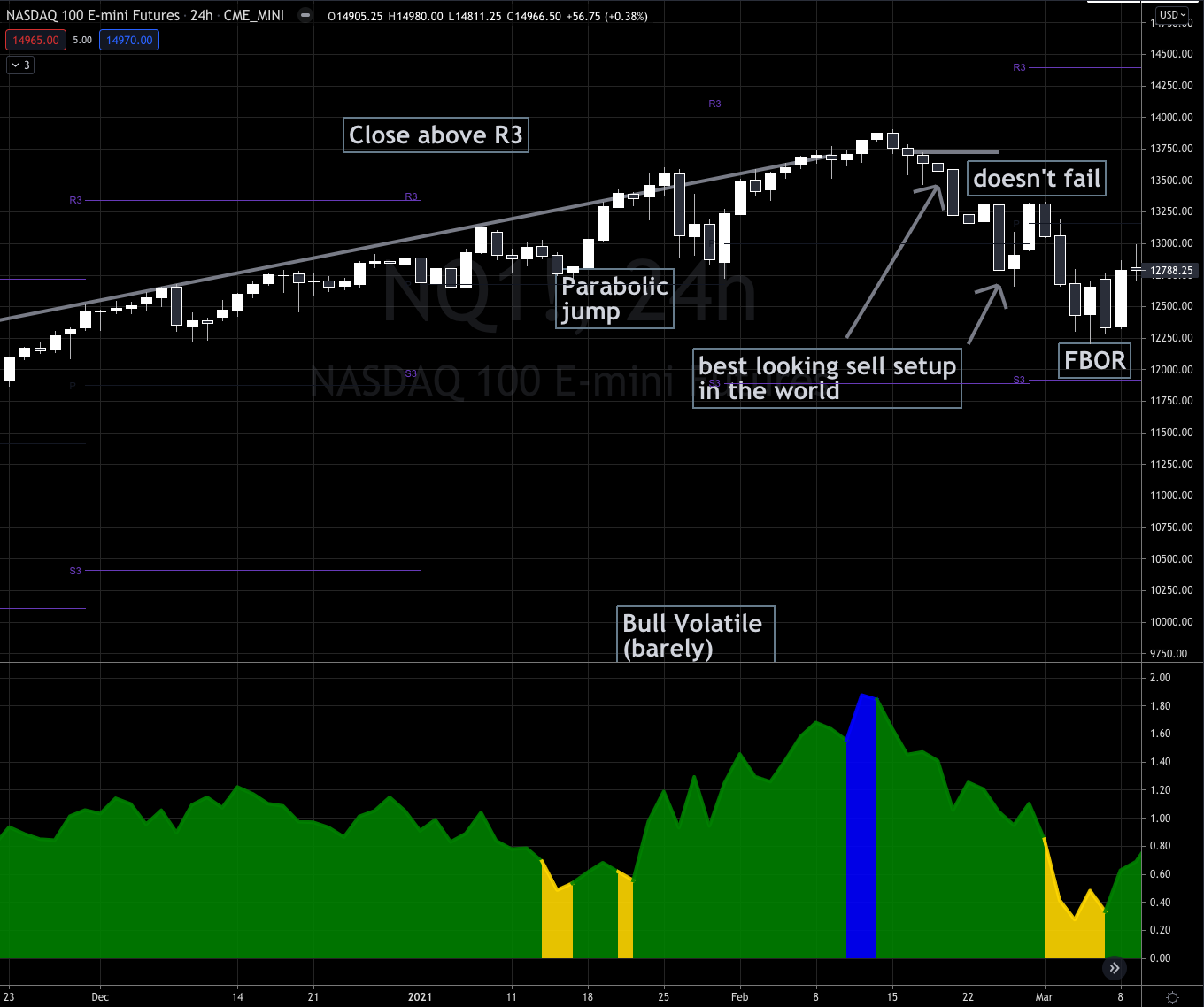

What gave us the heads up in February?

Our main test that we use for the $NQ is quite simply, in a bull quiet market regime, the best looking sell setups fail. Every time we get a pullback from the highs in $NQ we then wait for a really strong looking sell setup.

If $NQ fails to go lower, rejecting that beautiful sell setup, and proceeds higher, that is the $NQ passing the test, and we get long, or add.

February was setup in January, when the price of $NQ closed above the R3 pivot AND price jumped out of its trend channel, becoming parabolic. This was a warning that a major market top was available, not imminent, but was now a higher probability.

You might recall we tightened our stops and subsequently got stopped out on our $NQ long campaign, and took some long trades in $DIA and $FTSE, which did... OK.

In February, $NQ had a beautiful sell setup, which got rejected, suggesting that the bullish test of $NQ passed and we'd be heading higher...and we did.

But by mid February, we were putting in new all time highs, and jumped out of the channel again, this time printing a Bull Volatile SQN, now all three conditions for a major market top were achieved.✔️ ✔️✔️

Reminder, simply achieving all three requirements for a major market top doesn't mean that there will be a major market top, and certainly it doesn't mean that it'll happen any time soon. There are plenty of examples of these parabolic phases to last for months before even a whiff of a pullback. It simply means that the environment for a major market top to happen is available.

Shortly after checking all three boxes, $NQ sold off. But that's always expected in a bullish regime, so we test $NQ again by waiting for the best looking sell setup in the world, to fail. And it didn't fail this time, making a -12% selloff.

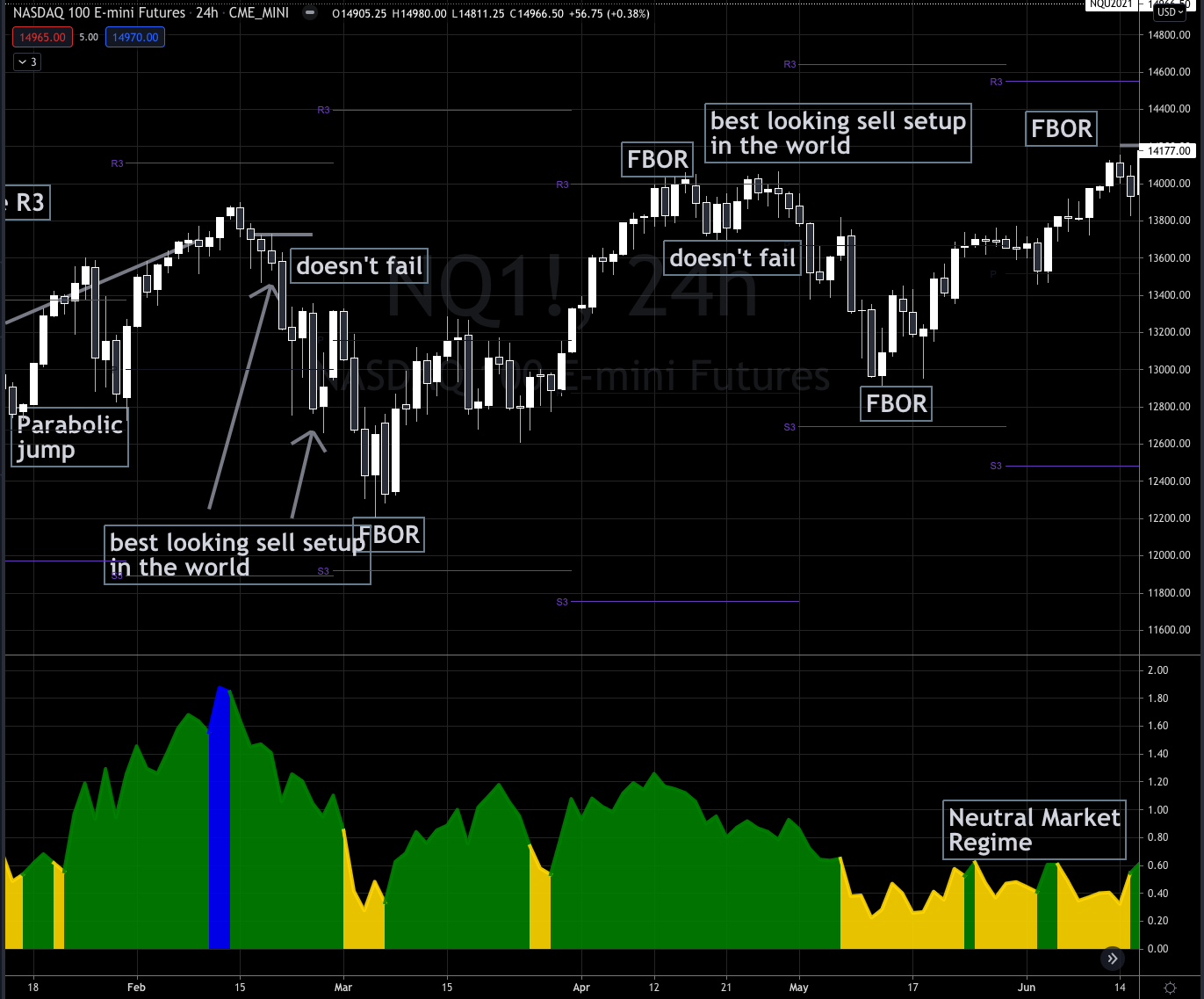

$NQ passed the "market is no longer bullish" test, so we removed our long only bull quiet strategy from our toolbox and instead pulled out our Failed Breakout mean reversion strategy from the toolbox.

Our test for $NQ in this environment is that failed breakouts work, and the best looking sell setups in the world don't fail, it's pretty simple.

From mid March to mid June we had four setups, three of them succeeded which is what you'd expect from a mean reversion strategy, a 75% win rate.

It is important to know these metrics, because if you are running a mean reversion strategy and your win rate isn't around these levels, you likely are running the wrong strategy for the market regime you are in, or you aren't stacking the appropriate edges to capitalize on that type of strategy.

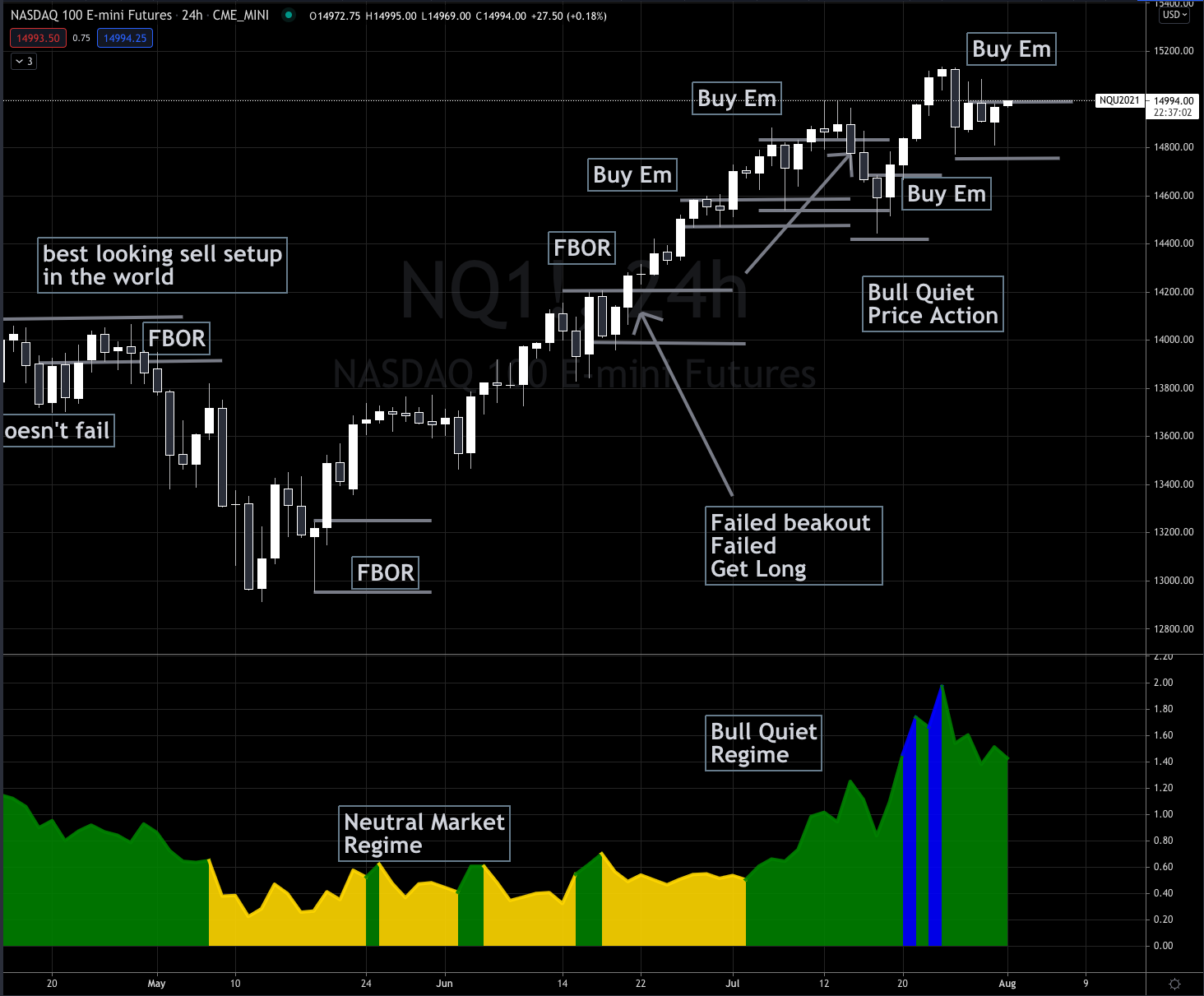

On our fourth attempt at the FBOR setup, the mean reversion failed to materialize, or utilizing our test framework for $NQ, the best looking sell setup in the world, failed.

When that setup failed we got a clear heads up that we were out of the mean reversion regime and back into the bull quiet/bullish trend regime.

Boom, back to bull quiet and back to using the appropriate tools, abandoning our mean reversion strategy.

And so we get long, and keeping adding to our long $NQ position waiting for the best looking sell setup in the world to fail.

We have bought and added five times now to our $NQ long position, getting pulled in to yet another contract Sunday afternoon on the open.

Unlike February and March when all three major market top requirements were met, only one of three was met so far. This suggests that we will continue to test the $NQ, and each time it passes our test, we'll be in a low risk environment to add to our position.

This is exactly the same way we traded the COVID bottom in March 2020, and adding to it until we hit all three major market top requirements by the end of August 2020, selling the actual top, going to cash and waiting for $NQ to again jump back in to the nice long bull quiet drift higher.

Yeah we didn't buy the absolute market low in March, because we are focused on low risk exposure, not bottom catching.

Much like we didn't catch the May 2021 bottom on $NQ, we waited for low risk tests to pull us into our trades.

TLDR; We want to get as much exposure to $NQ as we can safely get it, with the largest positions usually towards the end of the move, proper risk management will pull us safely out of the market when that happens, whether profitable or at a loss.

-------------

We run a number of different strategies here at Pollinate Trading in equities, futures, forex, commodities and crypto, from scalping $EURUSD and $RTY, to swing trading, to our monthly macro ETF strategy.

Last week a number of you reached out indicating that you'd be interested in paying to receive trade signals

We are currently working on launching a fund, which might negate our ability to offer this service, though the Trading Lab will still be available where we cover Crypto's, futures, forex and equity trades.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.