When Is The Santa Claus Rally?

Dec 06, 2022Every year, like clockwork, everyone starts talking about the Santa Claus rally.

As if it's this magical unknown random incident.

You see it every year on CNBC someone comes on and talks about their bullish/bearish case and puts the disclaimer at the end...

"...and if the Santa Claus rally shows up this year"

And of course Jim Cramer will jump on the bandwagon.

But believe it or not, we have some pretty good statistics on the year end effect, AKA Santa Claus Rally.

What would you expect from us nerds at Pollinate?

Usually attributed to tax loss harvesting, selling losing positions before the end of the year to be able to take the tax credit against this years capital gains. Since trading volume USUALLY drops to the lowest daily averages of the year during the last week or two in December, most selling happens the first half of the month.

Also, people are on vacation, traveling, with family and generally don't want to focus on the markets.

After this selling pressure dies, there's another event that hits the markets, every quarter and that's the Quad Witching event, which refers to a date when stock index futures, stock index options, stock options, and single stock futures expire simultaneously...this will happens on the third Friday in December.

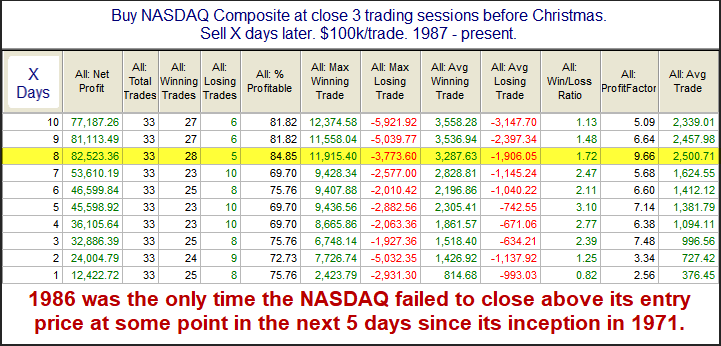

Historically, buying the market, in this case let's use the $NDX (Nasdaq 100), after quad witching and in the last two weeks of the year, then selling the January open produces the best results.

Particularly if you buy 3 trading days before Christmas and sell 8 days later, this would generate the most profit for you.

h/t @QuantifiableEdges on Twitter or https://www.quantifiableedges.com

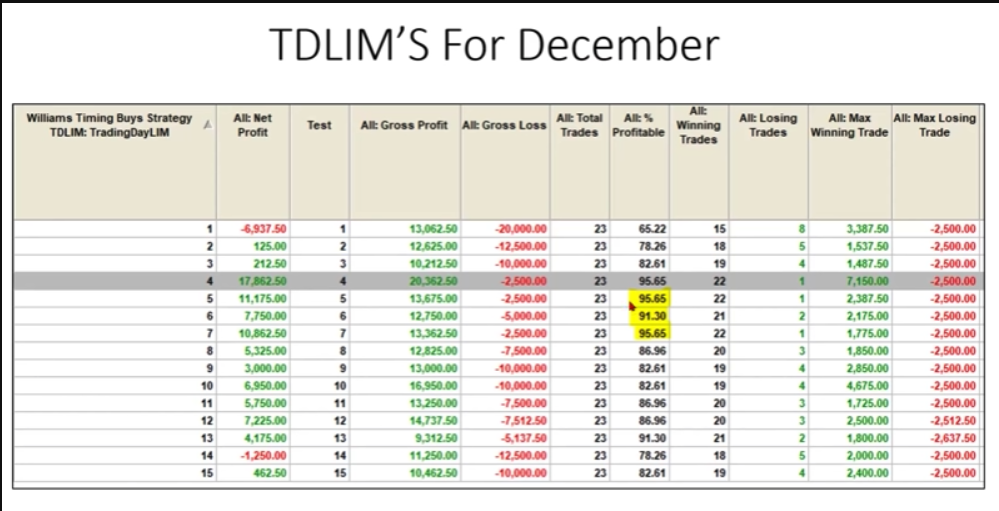

We can also look at Larry Williams Trading Days Left in Month for December which buys the $SPX X number of trading days before the end of the month.

h/t @SethGolden on Twitter or at Finomgroup.com for sharing this one.

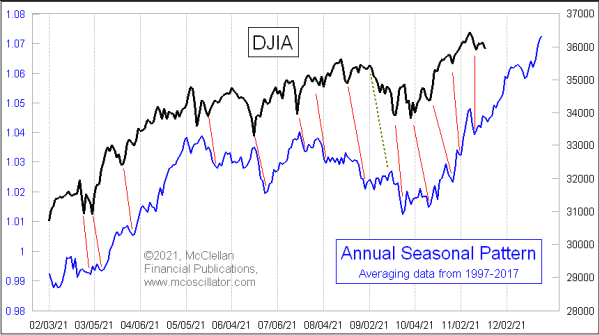

If we look at a seasonality chart going back to 1997, we can see that the $DJIA performs strongest from October in to the end of the year (minus a few hiccups along the way).

h/t @McClellanOsc on Twitter or at https:/www.mcoscillator.com for this one.

Clearly we have seasonality and statistics in our favor, with around an 80%+ win rate, in all market regimes.

This is the sort of work we do in the Trading Lab.

We use statistics to find the edges, structure opportunities around them and trade.

Whether we are day trading Curvy for 2R a day, or swing trading for 5-10R a month, the Trading Lab is the place to be for practical systematic trading, and turning a trading hobby in to a trading business.

----------------

Curvy Trading System - Trading the Curvy system eliminates the guessing game. Providing you with very consistent returns. Take the guess work out of your trading. Implementing the Curvy trading strategy allows you to know exactly that

Swing Beast Momentum System - The swing beast strategy's core function is to quickly take smaller accounts and grow them to larger accounts. This is done based on a core momentum strategy. Pulling you into the trade not forcing it and not guessing what's going to happen next.

Equity Earnings System - Don't get caught making the same usual gamble trades during earnings season ever again. Be in the right stocks that have a HUGE opportunity for winners when they release their earnings, and often times you get the price rip even before they announce. The Equity Earnings Strategy keeps you out of the high risk, low reward earnings trades that everyone on TV and Twitter are gambling on, and gets you in to the ones that make real money.

Systems Mastery Course - The Systems Mastery Course gives you what other gurus refuse to give you. Teaching you how to build robust trading systems, that take you from guessing and gambling in the markets to predictable, repeatable systems. Like the Pros. It also gives you the consistent results, you desire and provides you with all the tools needed to set you aside from 95% of traders leaving you in the top 5% of traders being successful.

Trading Lab -The Lab is a private Slack Channel where all lab members collaborate with each other. The Lab is designed to be a Journeyman/Apprentice model where experienced traders mentor newer traders on the strategies, markets and different techniques to manage risk, earn a living, and even get fully funded at a prop firm if you want to. There is dedicated slack channel to calling out all trades in real time, the exact entry, stop and how we will exit the trade if profitable, so you always know how to trade.We do livestreams throughout the week covering different strategies, answering questions, looking over the markets, and coming up with a plan to deal with all the different market conditions we see. We trade PROVEN strategies and we adapt for each different market regime. As a member of the Trading Lab, you’ll get the Trading Lab Master Trading Course. EVERYTHING you’ll ever need to know about trading! Also, there’s a library of 1,000’s of hours of videos if you really want to dig in. Numerous recordings of previous coaching and training sessions exclusively available to lab members.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.