Weekly Market Overview January 30, 2022

Jan 29, 2022This week we launched a daily morning note for Trading Lab members only in order to better get our teammates on the same page of what we're looking for in the current market conditions. Here's a look at Friday's morning note.

This week's Weekly Market Overview is down below.

What's happening today

https://tradingeconomics.com/

10 am (ET) Michigan Consumer Sentiment

https://eresearch.fidelity.co

$CVX missed on earnings but announced $3-5Bn stock buyback

$CAT reports earnings this morning

----Positions----

-Long $QQQ Feb 344 Puts

-Long $QQQ Feb 380 Calls

-Long $GME Feb 95 Puts

-Long $NKE Mar 165 Calls

I added to my QQQ Feb 380 calls on Thursday.

In the prop account I am completely flat all positions with buy stops resting on $NZDJPY but still no fill. Won't be taking any new looks at FX until Sunday's open.

----Trading Outlook----

$AAPL reported after the close of trading on Thursday and absolutely murdered their estimates, all-time record sales, and could not have been a better earnings report. But as everyone is now saying, maybe the market can't be wholly dependent on just $AAPL. As Jonathan, a lab member from France mentioned, $LVMH, the massive luxury brands conglomerate, is Europes Apple. They reported stellar earnings, which usually would rally the European markets, and we currently have Eurostox 50, CAC 40, Dax, FTSE all negative. While the world was riding bull market regime wave on the backs of the highly profitable (mostly) FAANGMT names led the way up, the remaining 493 names have led the way down.

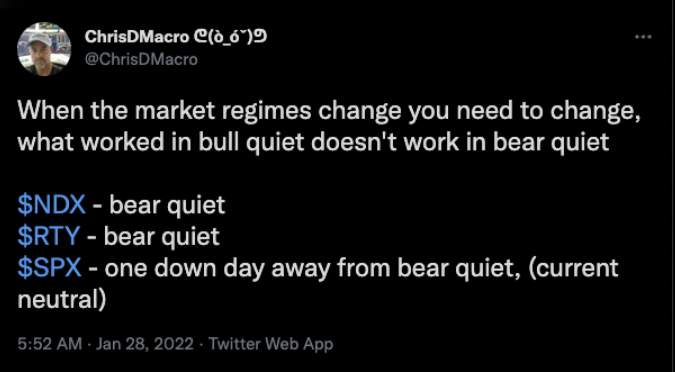

The US Equity Indices are all currently either in neutral or bear quiet market regimes.

https://twitter.com/ChrisDMac

$NDX - bear quiet

$RTY - bear quiet

$SPX - one down day away from bear quiet, (currently neutral)

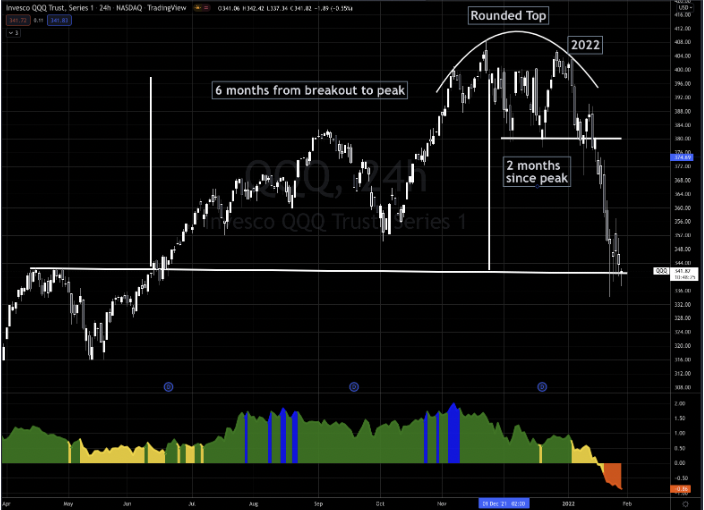

In 2022, so far, we've had 18 trading days, 6 of them were up days and 12 down days. With large moves down, with multiple -2%+ days. Those are characteristics of a Bull Volatile market regime, even though the SQN indicator is only showing a Bear Quiet market regime. Remember the SQN is a LAGGING indicator, it will eventually catch up, and it'll be late to the party. Taking a step back and the picture is clear for $QQQ (Nasdaq 100).

Clearly in a Bear Quiet Market Regime via SQN (Lagging Indicator)

Clearly in a Bear Volatile Market Regime via price action (Leading Indicator)

Obvious Rounded Top (in hindsight)

We are currently putting in an epic battle and the support line, of the June 2021 breakout levels of around 340 on $QQQ, with the January 24 lows having held up to the test of support at 334.16. There will be a mountain of longs that placed their stops right at this level making it a line in the sand. A move below that level will likely be met with accelerated selling and opens up the 320 which is the 38.2% retracement from Covid lows to November highs.

Since the January 24 lows have been held up so well we have a decent opportunity to get a snapback rally (bear market rallies are truly violent) up to around the 380 level, which is where $QQQ broke down and accelerated into a bear volatile regime.

Support becomes resistance when broken and the 380 level was support for the long term trend line up and also the horizontal breakdown line (generally), and the 61.8% fibonacci level from November highs to January lows. I'm using 61.8% here because as I mentioned, bear market rallies are violent, and getting above 50% would change a lot of minds. Why am I quoting $QQQ and not $NQ? Because I'm trading $QQQ via options which is a far more capital efficient way to limit risk than futures, unlike in the bullish regimes where I do use $NQ futures instead of options.

Why am I quoting $QQQ and not $NQ? Because I'm trading $QQQ via options which is a far more capital efficient way to limit risk than futures, unlike in the bullish regimes where I do use $NQ futures instead of options.

If the bull case is on, we'll be looking for our Swing Beast long setups to fire up the coming weeks.

Happy Trading (let me know if are old enough to remember that reference)

https://twitter.com/ChrisDMac

[email protected]

----------- End of Fridays Morning Market Note --------

Here's this past weeks notes if you are interested in seeing more about what we are focusing on each day.

Thursdays Lab Morning NoteDownload now

Wednesdays Lab Morning Note

Tuesdays Lab Morning Note

Mondays Lab Morning Note

The Monday note really nailed the plan and set up the entire week for us, identifying where the low of the week would be on the $ES (S&P 500) and the currency markets. Highly recommend you have a look at that note to get an idea of what's going on out there.

If you are interested in getting access to these morning notes and working with a team of traders from Hedge Funds, Professional Trading Desks, Family Offices, Prop Traders and retail traders alike (all are welcomed and loved!) with access to the Trading Lab Course exclusively for Trading Lab members which covers all of our trading strategies, position sizing methods, backtesting, research reports and the theories behind all that we do in the Lab.

---------------------------

Weekly Market Overview January 30, 2021

As this week has been even more dramatic than an already dramatic start to the new year, we've been on the right side of this down move so far, being short $QQQ (Nasdaq 100 ETF) via puts.

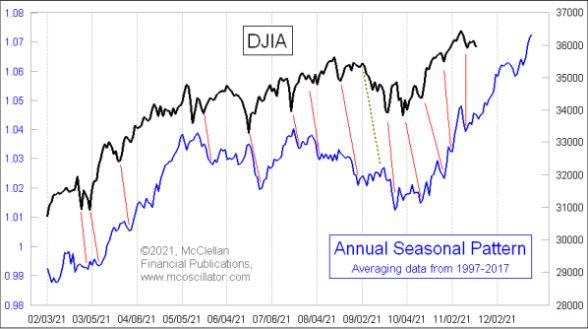

Historically, on average, the first quarter of any trading year tends to be a bit rocky but by March the momentum kicks back in and we resume higher into May.

That should give us is a decent two month rally which we will pick apart using our Swing Beast Momentum Strategy to grab some high return option trades to fund our summer frolicking!

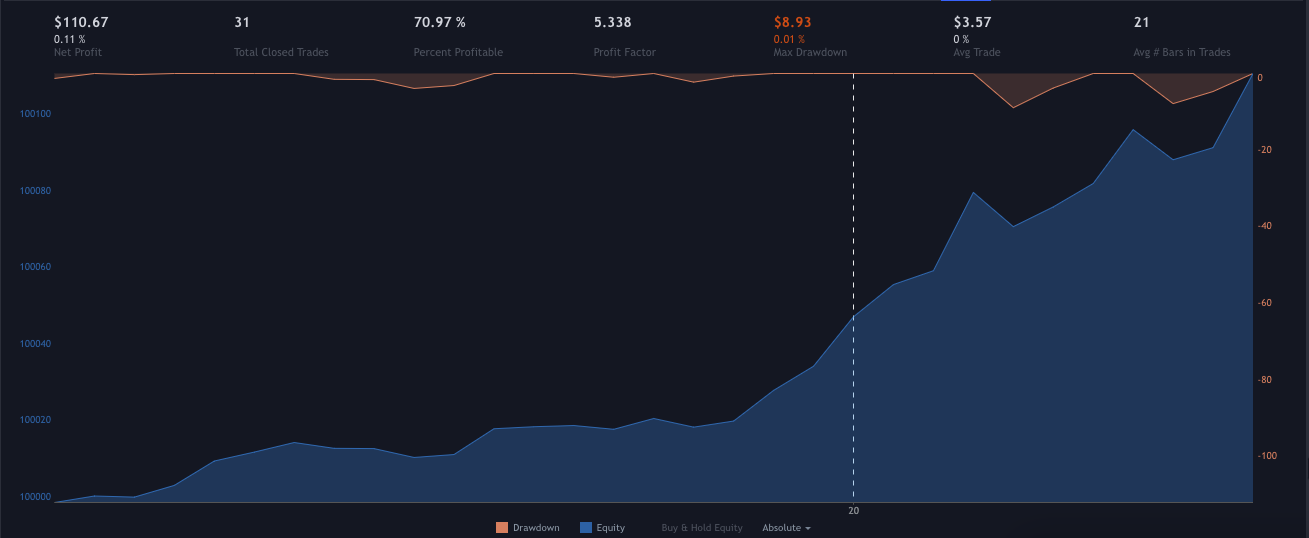

Here's a shot of the backtest of the Swing Beast Momentum Strategy on $AAPL from 2016 to Today:

Position Size = 1 Share

Net Profit $110.67

Avg Win $6.19

Avg Loss $2.83

Avg Trade $3.57

Max Drawdown $8.93

Win Rate 70.97%

Profit Factor 5.338

# Winning Trades 22

# Losing Trades 9

A momentum strategy with high R Multiples (big winners) is critical to growing an account. Yes base hits are incredible, and yes you should have a strategy to make money consistently day after day and week after week if you are going to be a professional trader, but momentum is what moves the needle. You just need to know when to and when not to use them.

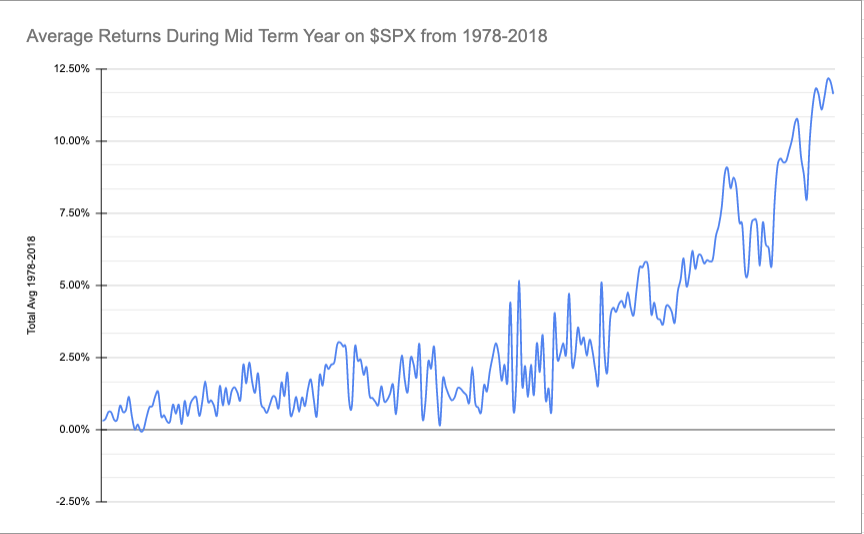

Since this year is a mid-term election year, this seasonality trade may not be as powerful and we might be mean reverting until elections are done as you can see by this chart which averages every mid-term election year returns on the $SPX from 1978 to 2018. Notice that the market trades mostly sideways and flat until the last 2-3 months of the year, roughly when mid-terms are done.

Speaking of the $SPX et's have a look at where we are on the index.

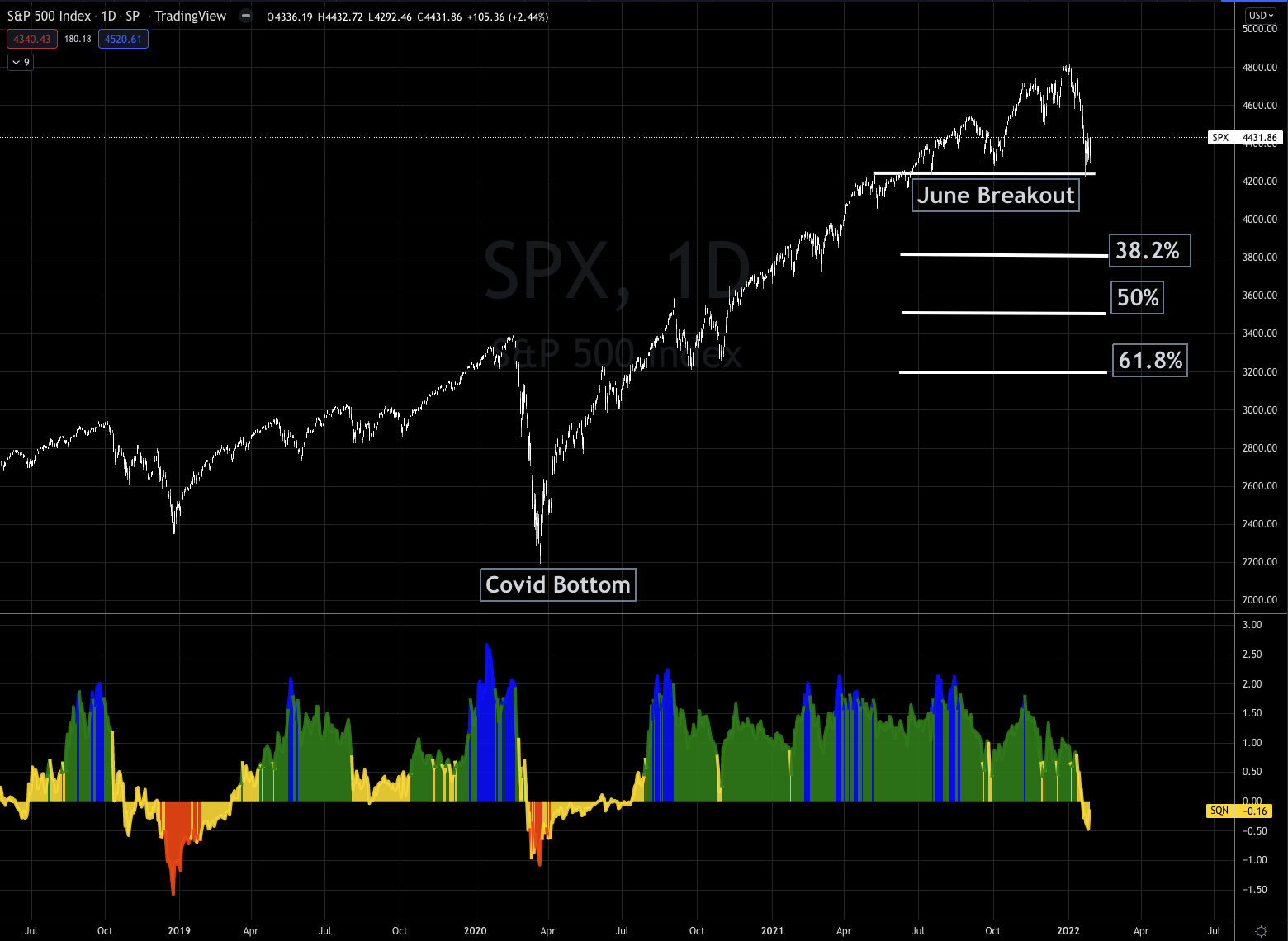

For the first time since the pandemic bottom in March 2020, the $SPX has moved into a neutral (negative) market regime. (Note, $NDX, $RTY are currently in bearish regimes). Remember the SQN (System Quality Number) is a lagging indicator which tracks the average daily change of the past 100 trading days. It tells us which direction the market has been going, and how big the daily % changes are. Higher daily % changes mean high volatility and lower % changes mean quiet volatility.

Dialing in the resolution we can see that Since 2022 began, the $SPX has fallen straight down from all time highs to retest the June 2021 breakout level, and this week we found support there.

January 21 low of 4222 has so far held this week and on Friday the markets took off closing at their highs, nearly at the high of the week.

It was a bullish trading day to say the least, with $AAPL smashing their earnings, $SPX a few ticks away from registering a 10% pull back from their highs (correction territory) and a lot of traders not wanting to go home short into the weekend, we had all the makings for a face ripping rally.

Bull Case

The $SPX/$ES/$SPY has put in a FBOR (Failed Breakout Retest) long setup suggesting a move to 4680 ($SPX) is available if we get above our entry level, this is a high win rate strategy in this market regime. The risk range is massive at about 150 points of Risk, so it is a big ask, we'll be on the lookout for an inside day this week to tighten up risk/reward parameters.

(Lab Members have full access to this strategy in the Strategy Library)

Further bullish levels are the Fibonacci retracement levelsfrom Jan 4 high to January 21 lows

4460 (38.2%),

4530 (50%)

4600 (61.8%)

Bear Case

Up to this point the January 21 lows on $SPX have held up and if markets are weak and this rate policy change language is supported with 7 rate hikes and more importantly balance sheet reduction we could see further weakness. The rate of change of any of those rate hikes or balance sheet reduction seems to be what everyone is so worried about.

The $SPX has moved in to a neutral regime, but the price action has been entirely Bear Volatile price action. If that's the case we would expect to see a bear volatile reading on SQN and the only way we get that is through further downside volatility.

Right now the line in the sand is January 21st low of 4222, there will be a mountain of stops resting at that level by dip buyers, and if those get ran, we could see another fast move down.

And that brings in to play, where do we expect support to step in?

Since the March 2020 bottom, we have not had a single Fibonacci retracement and this current move down is the first big pullback we've had since 2020.

If this gets going lower I'm keeping my eye on these Fibonacci levels from March 2020 lows to January 2022 highs:

3800 (38.2%)

3500 (50%)

3200 (61.8%)

How I'm Positioned

As I mentioned in the Friday note, I'm currently in:

-Long $QQQ Feb 344 Puts

-Long $QQQ Feb 380 Calls

-Long $GME Feb 95 Puts

-Long $NKE Mar 165 Calls

50% Cash

I am positioned for either the bull or bear outcome, and picked up a speculative DOTM position in $NKE.

If we rally in equities, I've got deep out of the money calls on $QQQ for a move up to 380 level, and my bearish position is already quite profitable and expect further and uglier lows to follow.

What works in a Bull Market doesn't work the same in Bear Markets, you need to have a strategy to trade the bear markets. Yes that can be simply going to cash.

Notice how everyone was screaming about market internals and breadth for the past two years, while the $SPX roared to new all time highs, day after day and week after week. They don't matter in a bull market.

But they are extremely helpful in bear markets!

Currencies

When markets get scary, the Dollar gets the love. You can clearly see that the US Dollar ($DXY) was already strong compared to the other major currencies, but when the markets really started to nosedive January 13th, they came rushing in to the safety of USD.

This has been the case already since Jun of 2021, every other major currency is down vs the Dollar and it seems to be accelerating.

If volatility continues in Equities, we can expect the USD pairs to continue to climb.

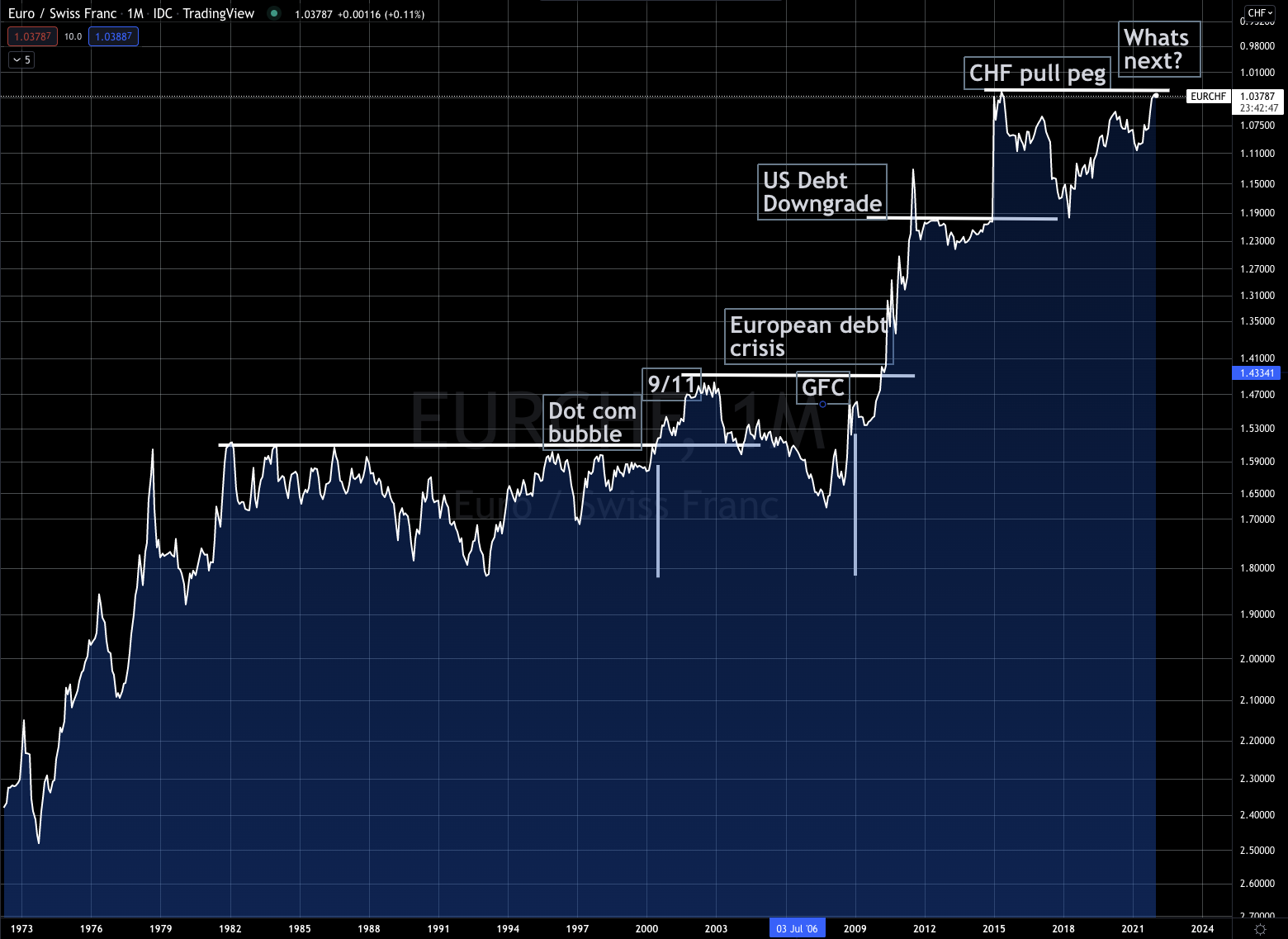

All of the major pairs vs USD are in Bear Quiet regimes except Canadadian Dollar and Swiss France. Canada is an energy related currency, so the high prices of crude are keeping their currency from falling as hard, and Swiss Franc is a flight to safety especially from Russia and other European countries with war on the doorstep.

With $EURCHF on the brink of all time low prices (all time highs for Swiss Franc) that continues to suggest something very volatile in the world is potentially upon us. (Inverted EURCHF chart)

Today as FX markets open worldwide, I'm interested in the FBOR long setup on $EURJPY.

These currency trades have been very accurate it so far this year winning 5 out of 6 trades. (Lab members have access to this strategy)

That's it!

Stay safe out there this week friends! And join us in the lab if you are having a tough time in this market, it's easy to make money in roaring bull markets, but when things get bearish quickly, it's important to have a team to work with and sort things out.

If you find this useful and you know other traders or investors who'd find it helpful, it'd be a HUGE favor if you forwarded this email along to them!

Happy Trading!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.